In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-01 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)08/27 Report--

Since 2020, under the environment of improving sales and performance, the share price of Xilai Motor has continued to climb. By yesterday, the latest closing price of US stocks rose 19.17% to 20.44 yuan, with a market capitalization of US $24.2 billion, setting a new all-time high.

It is believed that many netizens could not bear to see such soaring share prices, saying "how to buy American stocks" or "had known that they had chosen to buy some of the stocks that came from NIO". After all, NIO's share price, which hit a low of $2.11 this year, has risen 745.5%, compared with $3.72 at the beginning of the year, and has risen 379.6% this year.

Last year, when Xilai Motor experienced a variety of "negative" news, its share price fell to a low of 1.35 US dollars per share in a rare seven-game row. at that time, it was even given the possibility of "delisting" by a number of institutions, and its founder Li Bin was called the worst person in 2019. However, according to the latest stock price, Li Bin, who owns 13.8 per cent of the shares, is equivalent to an increase of $470 million, or about 3.2 billion yuan, overnight. Compared with the all-time low of $1.35 per share, it is now equivalent to a stock price increase of more than 15 times.

The frequent increase in share prices is also due to the fact that some time ago, Xilai Motors handed over the best quarterly results in the company's history. According to the financial report, in the second quarter of this year, the total revenue of NIO was 3.7189 billion yuan, an increase of 146.5% over the same period last year and 171.1% month-on-month growth, a record high. At the same time, it also exceeded the company's previous forecast revenue limit of 3.5342 billion yuan, and the net loss continued to narrow to 1.177 billion yuan, down 64.2% from the same period last year and 30.4% from the previous month.

In addition, NIO also achieved a positive gross profit margin for the first time in the second quarter, with a gross profit margin of 8.4%, minus 33.4% in the same period last year, and minus 12.2% in the last quarter. Obviously, the ability of self-hematopoiesis has also been greatly enhanced.

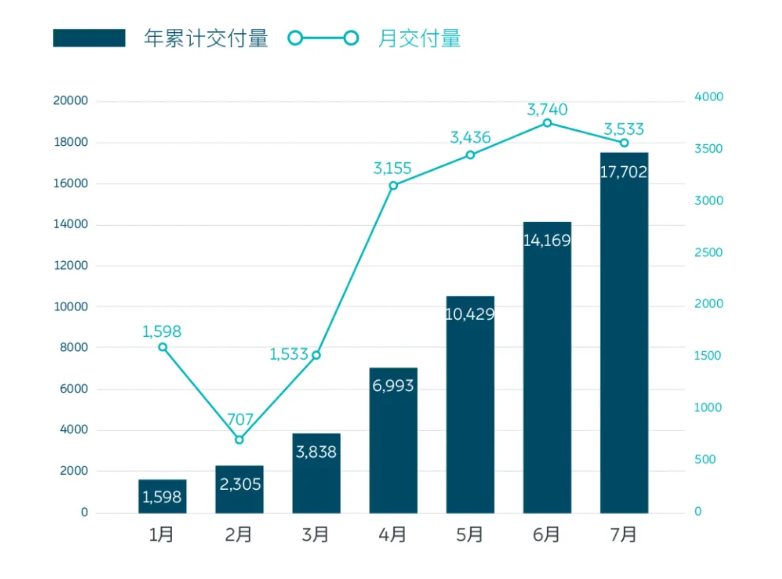

Data show that a total of 17702 ES8 and ES6 vehicles were delivered in 2020, of which 10331 were delivered in the second quarter, exceeding the forecast limit of 10000 in the first quarter, up 190.8 percent from the same period last year and 169.18 percent from the previous month. In terms of sales from January to July, sales of Xilai have picked up since April, delivering a total of 3533 new cars in July, four times more than the same period last year.

Therefore, with the good performance of sales, it has been favored by a number of institutions, and UBS, a well-known international investment bank, issued a report to upgrade the stock rating from "sell" to "neutral". And another well-known international investment bank Morgan Stanley upgraded the stock rating from neutral to buy in the report, raising the target price from $12 to $20.50.

Some industry analysts said he was increasingly optimistic about the company's medium-term prospects after a phone call with the management team of Xilai. It believes that the increase in production and battery ordering plans of Xilai make it easier for car investors to see the growth of car sales in the next few years.

At the same time, as for the business development in the second half of the year, Li Bin, founder and chairman of Xilai, also said: "We are very confident that both the vehicle gross profit margin and the comprehensive gross profit margin will exceed 10% in the second half of this year."

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.