In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-01 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)07/25 Report--

Recently, the gem listing Committee held its 41st issue and examination meeting in 2021 and approved the IPO application of China Automobile Research Automobile proving ground Co., Ltd. (hereinafter referred to as "China Automotive proving ground"), which is the first share of the automobile testing ground on the A-share market.

According to enterprise information, the CNAC proving ground was established on March 30, 2011, and its legal representative, an Tiecheng, is invested by China Automotive Technology Research Center Co., Ltd. (hereinafter referred to as "China Automotive Technology Research Center"). Jiangsu Yueda Group and Jiangsu Dafeng Seaport holding Group participate in the shares, of which CNAC holds 51%, while the latter two own 39% and 10% respectively. This landing on the gem of the China Automobile Test site, is the above-mentioned China Automobile Center Yancheng branch.

According to official data, the main business of the Sinochem proving ground is to provide site test technical services for customers such as automobile production enterprises, automobile inspection institutions, automobile chassis parts system enterprises and tire enterprises through the construction of automobile site test environment and test scene. Including Mercedes-Benz, BMW, Volkswagen and other joint ventures, Geely, Chery, BAIC, FAW, Guangzhou Auto and other independent enterprises, BYD, BAIC New Energy, Xilai and other new energy and car manufacturing enterprises, all regard the China Automobile proving ground as the most important R & D base.

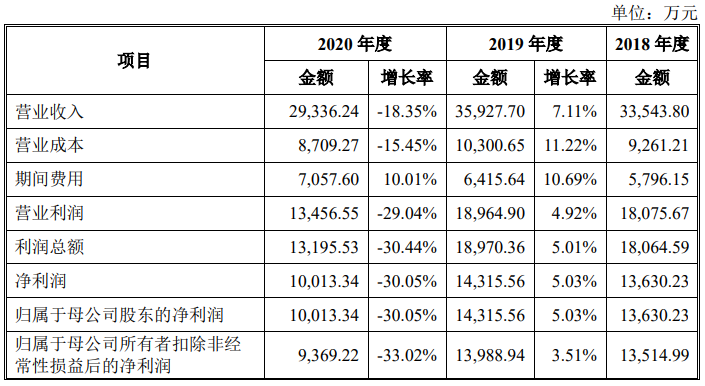

According to the prospectus released by the listing Committee, from 2018 to 2020, the operating income of the Sinochem proving ground was 335 million yuan, 359 million yuan and 293 million yuan respectively, and the net profit was 136 million yuan, 143 million yuan and 100 million yuan respectively. The three-year comprehensive gross profit margin was 72.39%, 71.33% and 70.31% respectively, while the company employed less than 100 people. Such profits are rare in the upper, middle and lower reaches of the automobile industry. Take Toyota, the world's highest-selling car, as an example, with a gross profit margin of 18% in 2020, 16.7% for Porsche and 18% for Ferrari, while gross margins for mainstream foreign brands and second-tier luxury brands are basically below 10%.

As a proving ground, why is the gross profit margin so high? According to people familiar with the matter, the automobile proving ground is an industry with relatively high threshold and early input costs, but very low maintenance and operating costs in the later stage. "first of all, there is a need for qualifications issued by relevant state departments, and secondly, there is a very high demand for land occupation, and the government has clear requirements and restrictions on the use of such test sites."

At present, there are only six national vehicle testing institutions fully authorized by the competent government departments in China, and automobile companies will even sign a contract with the test site for a whole year in order to carry out the necessary pre-market inspection and testing as soon as possible. Since 2004, the business of the test site has been quite booming, car factories are queuing up for testing, and the testing cost is relatively high, and the price of a small test and test may be as high as five or six million yuan.

However, with the increase in sales of car companies, some car companies have also begun to build their own test grounds to meet the testing needs of their models. For example, SAIC GM has built a test ground in Guangde, Anhui Province, and SAIC GM Wuling has also built its own test site in recent years. However, with the acceleration of intelligent electrification and networking of cars, the demand for new testing application scenarios is also accelerating. Therefore, the Sinochem proving ground is also looking for listing to raise funds to further expand its investment in the areas of intelligence, self-driving and interconnection.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.