In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-01 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)07/08 Report--

A few days ago, the Beijing property Rights Exchange put up an announcement of "100% equity transfer of a Beijing Automotive Technology Co., Ltd.". The announcement did not disclose the specific name of the enterprise, but announced several key information about the enterprise. including the place of registration is Tongzhou District of Beijing, the establishment time is 2020, the registered capital is 100 million yuan, after the establishment, only one vehicle manufacturing enterprise has been invested, and the reference price of 100% equity is 700 million yuan.

Summing up the above information, "Automotive Industry concern" learned through Tianyan inquiry that there is only one enterprise that meets all the above conditions at the same time. This enterprise is called "Beijing Blue Sparrow Automotive Technology Co., Ltd." (hereinafter referred to as "Beijing Blue Sparrow"). It is the wholly-owned controlling shareholder of Hebei leading Motor and holds 100% stake in Beijing Blue Sparrow.

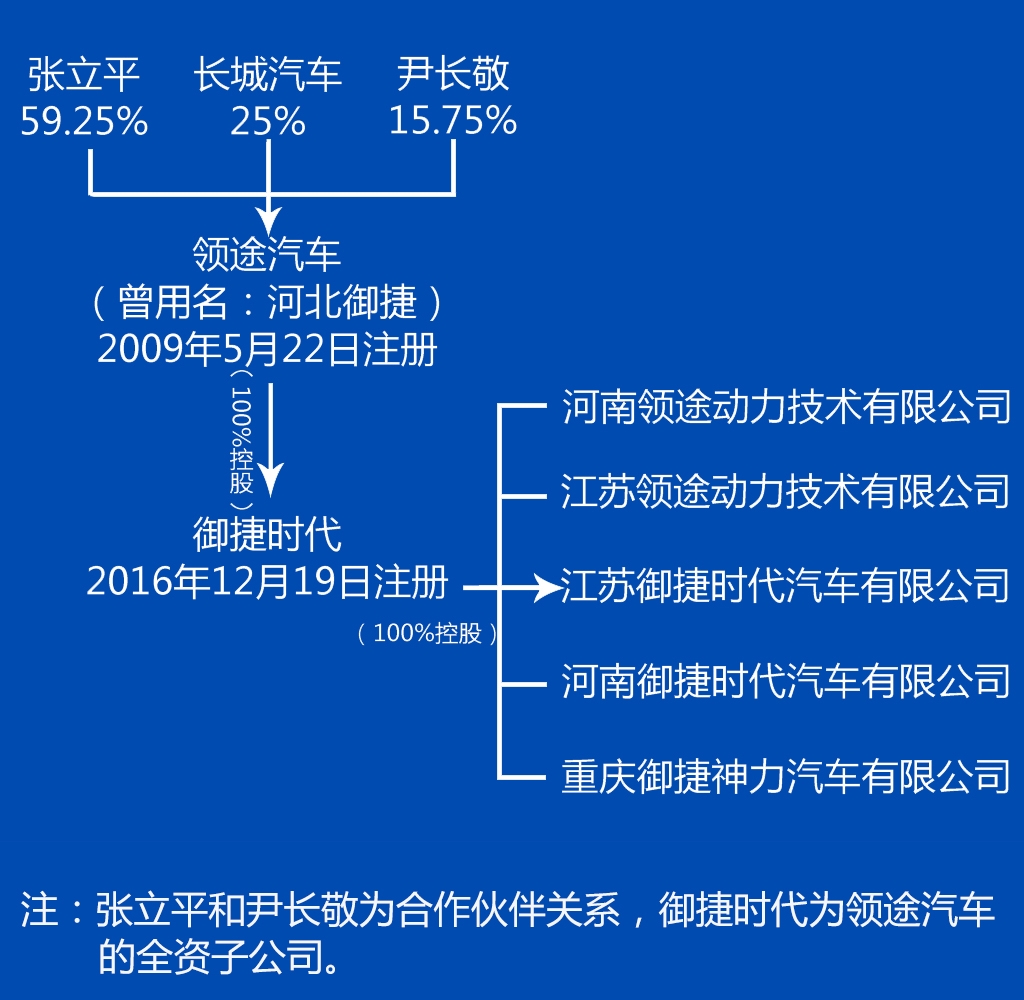

Data show that the predecessor of the leading car is Hebei Yujie car Industry, which was established in May 2009, and started with low-speed electric vehicle business. In May 2017, Great Wall Motors, which is also located in Hebei Province, agreed with Uncle Qianshu of Yujie Motor Industry under the agreement that Great Wall Motors will increase its stake in Yujie Motor Industry in cash, with a stake of 25% for the first time, with a maximum of 49%. In September of the same year, Great Wall Motor took a stake in the Royal Jie Automobile Industry and completed the industrial and commercial change. In June 2018, Yujie car industry changed its name to lead car, transformed from low-speed electric vehicle industry to four-wheel electric vehicle industry, and became a member of the new power of car-building.

The Yujie car industry used to be the king of the domestic low-speed electric vehicle industry. It has three major production bases: Qinghe Base No.1 Factory, Qinghe Base No.2 Factory and Qihe Base, with an annual production capacity of 300000 vehicles. The three bases all have four major workshops of car production technology: stamping, welding, painting and final assembly, which have formed a complete system of research and development, manufacturing, sales and after-sales service of electric vehicles and key parts. According to Zhang Liping, chairman of Yujie, there are more than 200000 customers and 2000 dealers at present. It is understood that before it was renamed as a leading car, it ranked first in sales in the industry for 10 years in a row, with a cumulative sales volume of more than 300000 vehicles, although it was only involved in the field of low-speed electric vehicles, but this achievement was enough to make the traditional car companies under the pressure of the coming new energy vehicles at that time look sideways.

In July 2017, Yujie Motor Industry obtained the production qualification of new energy pure electric cars through acquisition and upgrading. As we all know, it is necessary to enter the field of new energy passenger cars, but the financial strength is also a decisive factor related to the success of a car company. As a result, Great Wall Motors, which is also located in Hebei Province, has taken a stake in the Yujie car industry, which has increased the important driving force and more development possibilities for the transformation of Yujie into pure electric passenger cars.

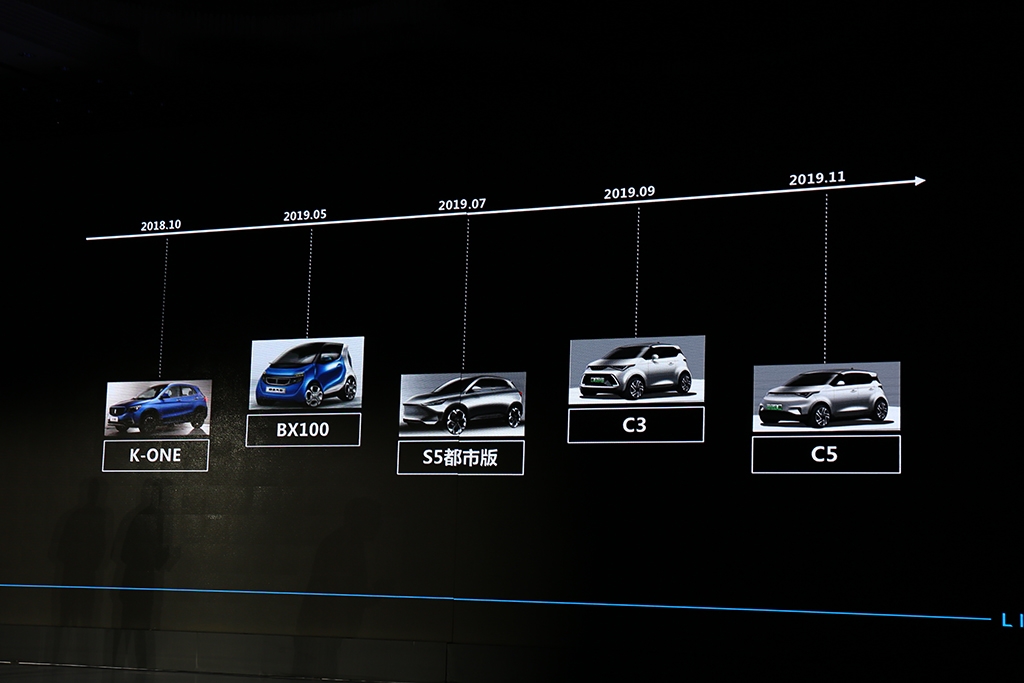

After that, Yujie Group spun off its low-speed electric vehicle business to establish Yujie era Development, while it transformed into a pure electric passenger car business in a joint venture with Great Wall Motor, and tried to break out a world in the burgeoning new energy vehicle market. That year, the leading car showed off five electric car products. The first model, the leading K-ONE, went on sale in November 2018. According to the data, the total sales of leading cars in 2018 was 9224, ranking 15th in the industry. Although the results were mediocre, the start was not bad.

Zhu Yikun, then general manager of leading Automotive products, said at the partner recruitment season meeting of leading Automobile City in 2019: "the sales target of leading cars in 2019 is to ensure 30, 000 vehicles, strive for 40, 000 vehicles, and then launch at least one new model every year; by 2020, we will strive to achieve annual sales of 100000 vehicles, with sales reaching 8 billion-10 billion yuan." Then, before the grand blueprint of 100000 or 10 billion was unfolded, the decline of leading cars began to appear.

In June 2019, the production of lead cars was completely stopped. In July 2019, leading cars began to have financial difficulties, the factory was in a state of semi-shutdown, employees paid only a minimum living security, and suppliers began to claim arrears. In December 2019, Great Wall withdrew from the leading car shareholder industry, but the 25% stake was still taken by Shenzhen Great Wall Automobile sales Co., Ltd., a subsidiary of Great Wall Motors. In June 2020, the Qinghe County Court of Hebei Province ruled to accept the reorganization of leading cars. In January 2021, the lead car entered the substantive restructuring stage, and Beijing Blue Sparrow Ling was finally identified as the restructuring investor.

Tianyan survey shows that Beijing Blue Sparrow Ling was established on September 2, 2020, with a registered capital of 100 million yuan, which is wholly owned by Han Changjin. According to the introduction, Beijing Blue Sparrow Ling has made a strategic plan for the future operation of the pilot car. From the point of view of the draft reorganization plan, improving the level of management, increasing investment in R & D, increasing investment in brand promotion and channel expansion, stripping non-performing assets and implementing equity incentives will all become the core of the future business plan. Among them, it is clear that after the restructuring, the leading company will focus on A00-level intelligent network-connected new energy passenger vehicles, covering the new car consumption ecology of car purchase, rent, finance, and recharge. it is estimated that product sales will reach 10, 000, 50, 000 and 80, 000 units respectively from 2021 to 2023, with sales reaching 350 million yuan, 1.75 billion yuan and 3 billion yuan respectively.

After Beijing Blue Sparrow Ling participated in the restructuring of the leading car, it launched a new Bazhi bear in October 2021, positioning a miniature pure electric vehicle, such as the standard Hongguang MINIEV and Chery QQ ice cream, which currently sells for 3.88-58800 yuan. As the second production car, the pilot car, which was scheduled to go on sale in the first half of the year, has been shelved. According to the data of the Federation of passengers, Baizhi Bear has sold a total of 10396 vehicles since its launch, far lower than the Hongguang MINIEV and Chery QQ ice cream models of the same level.

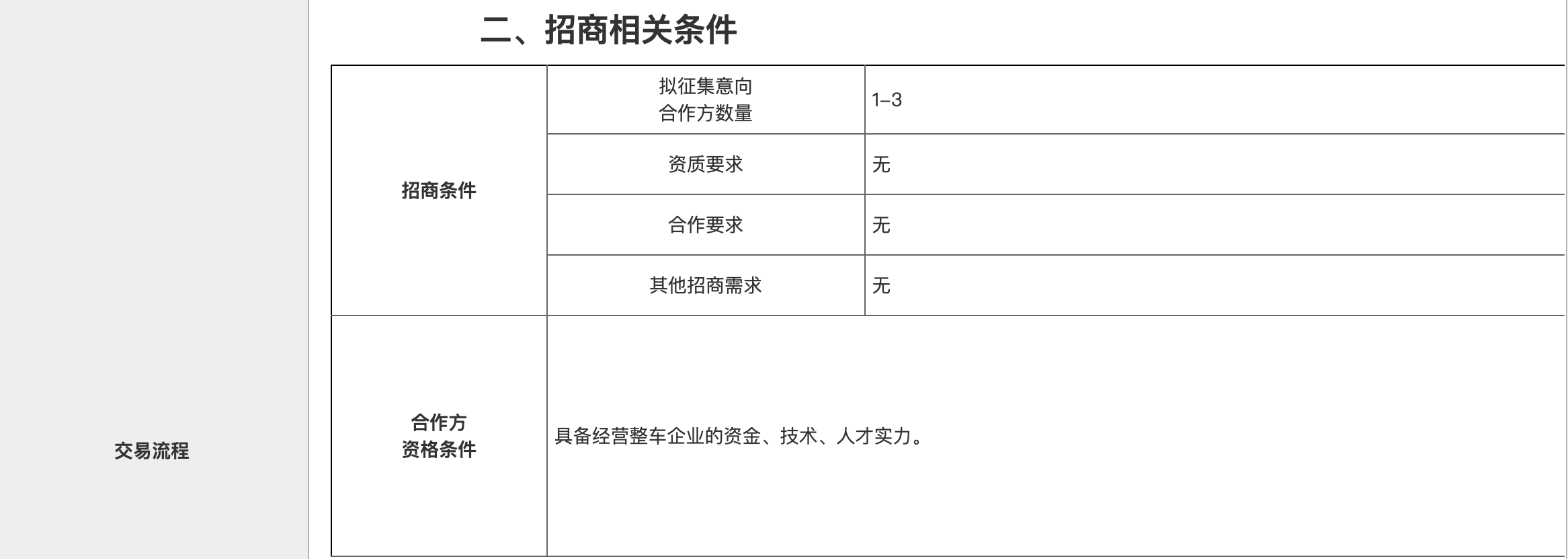

According to the equity transfer announcement, leading cars can produce pick-up trucks, van logistics vehicles, SUV, MPV fuel vehicles, as well as pure electric passenger vehicles, with complete land, plant and equipment for vehicle production. Normal production before April 2022, affected by the epidemic since May, is currently in a state of passive temporary suspension of production. As for the investment conditions, the equity transferor has only one requirement, that is, it has the capital, technology and talent strength to operate the whole vehicle enterprise.

In the low-speed electric vehicle industry, because their own identity is not fully in line with the laws and regulations, they can only walk in the gray area, so finding an automobile production qualified enterprise to cooperate has become a common way for low-speed electric vehicle enterprises to survive. In addition to Great Wall Motors' stake in the Royal Jet car industry, such as Shandong Reading's acquisition of Sichuan Automobile Mustang and Shandong Baoya's acquisition of FAW Geely, these are all examples of low-speed electric car companies seeking new paths for development, but so far few have been able to get out of the predicament. This time, the lead bus has been listed for transfer again, and who is willing to take the offer?

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.