In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-01 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)05/23 Report--

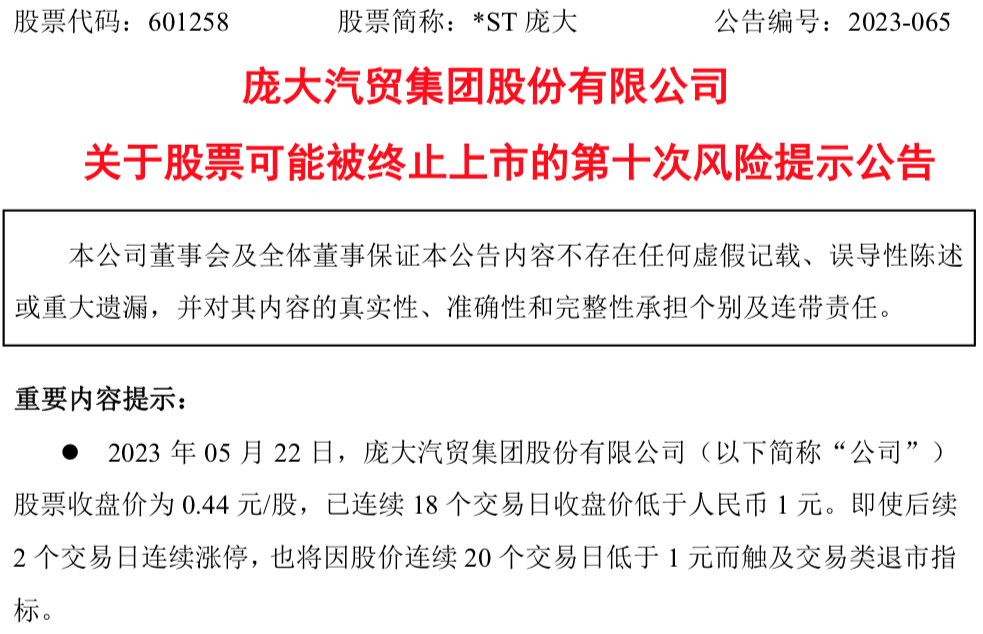

On May 23, *ST issued an announcement saying that the closing price of shares of Pangda Auto Trade Group Co., Ltd.(hereinafter referred to as "the Company") on May 22 was 0.44 yuan/share, which has been lower than RMB 1 yuan for 18 consecutive trading days. Even if the following 2 trading days continue to rise, but also because the stock price for 20 consecutive trading days below 1 yuan and touch the trading delisting index, into the termination of listing procedures. This also means that the delisting of this car dealer, once the largest in the country and with more than one thousand 4S stores, has become a "nail in the coffin".

On April 22, Pangda Group issued the Risk Warning Announcement on the Possible Termination of Listing of Shares for the first time, indicating that the Company has delisting risk. From May 11 to May 23, Pangda Group successively issued nine Risk Warning Announcements on the Possible Termination of Listing of Shares, prompting investors that the listing of shares may be terminated.

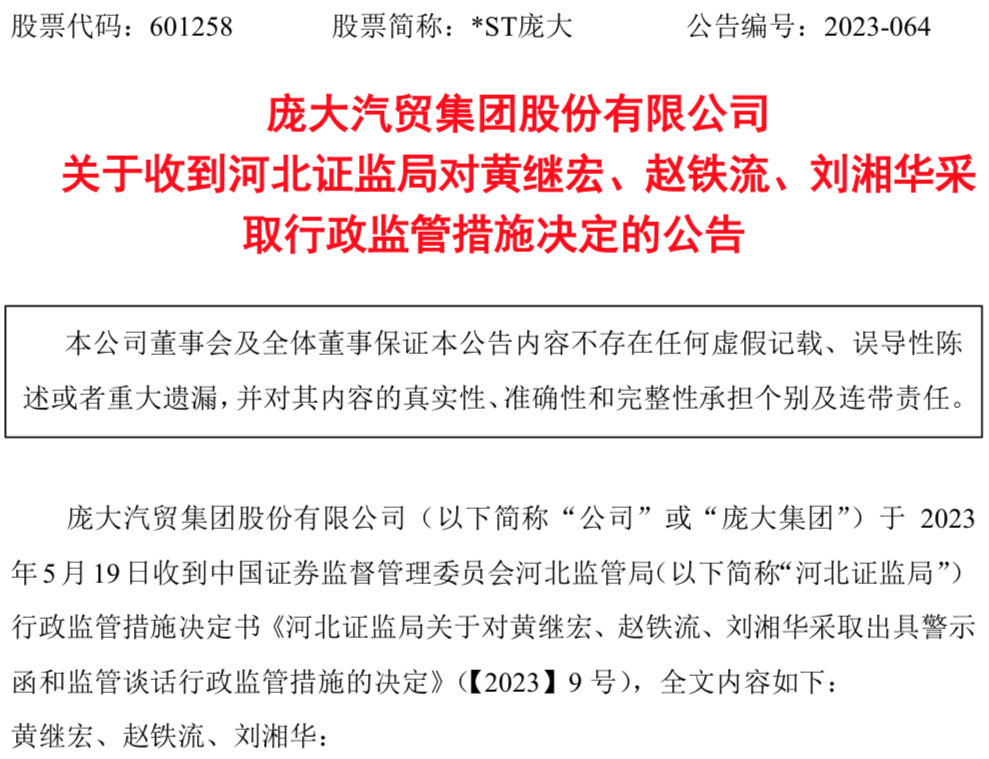

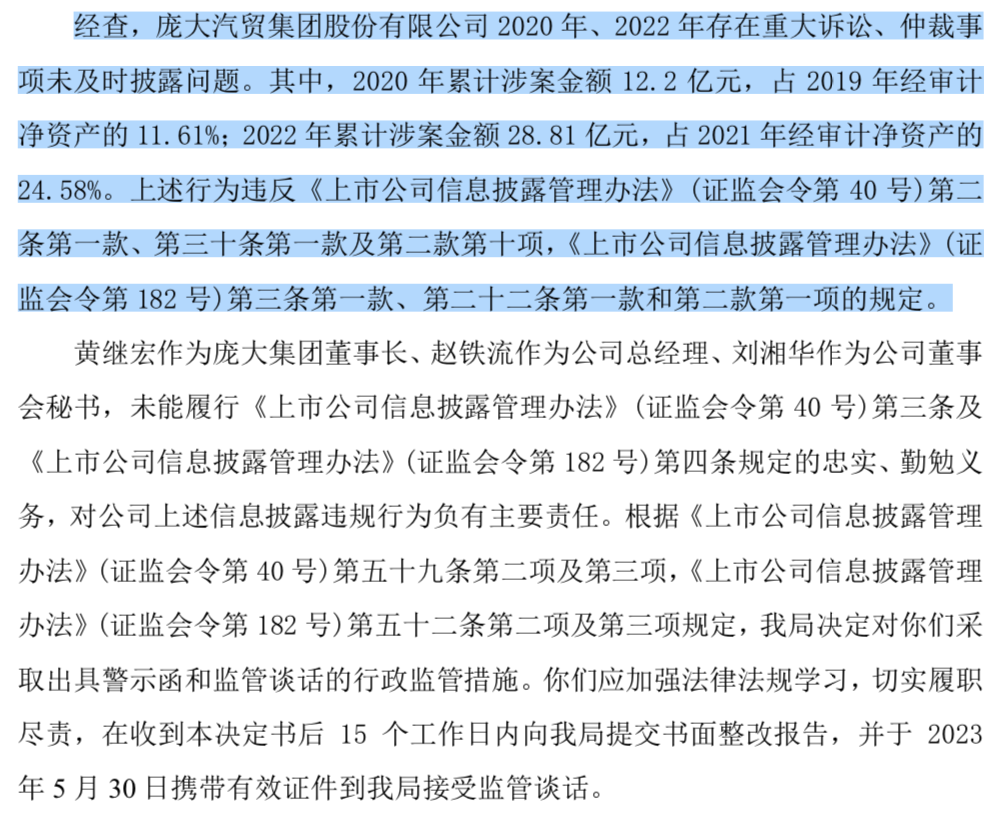

On May 20, ST Pang disclosed in the announcement that Pang Da Group received the Hebei Supervision Bureau of China Securities Regulatory Commission on May 19,2023.(hereinafter referred to as Hebei Securities Regulatory Bureau) Decision on Administrative Supervision Measures Decision of Hebei Securities Regulatory Bureau on Issuing Warning Letter and Supervision Talk to Huang Jihong, Zhao Tieliu and Liu Xianghua ([2023] No.9) and Decision of Hebei Securities Regulatory Bureau on Issuing Warning Letter Administrative Supervision Measures to Pangda Automobile Trade Group Co., Ltd.([2023] No.8).

According to the content of the decision, Hebei Securities Regulatory Bureau found that there were major litigation and arbitration matters not disclosed in time in 2020 and 2022. Among them, the accumulative amount involved in 2020 is CNY 1.22 billion, accounting for 11.61% of the audited net assets in 2019; the accumulative amount involved in 2022 is CNY 2.881 billion, accounting for 24.58% of the audited net assets in 2021. The above-mentioned acts violate the provisions of Paragraph 1, Paragraph 1 and Item 10 of Paragraph 2 of Article 2 of the Measures for the Administration of Information Disclosure of Listed Companies (Order No.40 of CSRC), Paragraph 1 of Article 3, Paragraph 1 and Item 1 of Paragraph 2 of Article 22 of the Measures for the Administration of Information Disclosure of Listed Companies (Order No.182 of CSRC). In response, Hebei Securities Regulatory Bureau decided to take administrative supervision measures to issue warning letters to the huge group, and said that the huge group should submit a written rectification report within 15 working days after receiving the decision.

On the previous day, Pangda Group also received the Supervision Work Letter on Matters Related to Letters and Complaints of Pangda Automobile Trade Group Co., Ltd. issued by Shanghai Stock Exchange. According to the content of the regulatory work letter, there are complaints from investors that the company, controlling shareholders and actual controllers have hollowed out cash and assets of listed companies, evaded restructuring performance commitments by delisting, false repurchase of listed companies and other violations.

Pangda Group is a large automobile dealer group focusing on automobile sales services nationwide. Its main products include passenger cars and commercial vehicles. In April 2011, Pangda Group was officially listed on the Shanghai Stock Exchange, becoming the first auto trade group in China to realize six A shares through IPO. Data show that from 2009 to 2011, the total revenue of the huge group was 35.2 billion yuan, 53.8 billion yuan and 55.6 billion yuan, among which in 2009, it became the champion of Chinese automobile dealers. In 2011, it became the first automobile trade group in China to realize six A shares through IPO. After listing, the total market value once reached RMB 55.8 billion yuan. In the next year, there were 1429 business outlets and 754 4S stores.

Against this background, the huge group expanded its global layout on a large scale. In 2004, Pang Da Group established Subaru Asia's largest 4S store in Wufangqiao, Beijing, and established Zhongji Subaru in the sole proprietorship of Pang Da Auto Trade Group. Since then, through its subsidiary Zhongji Subaru, it obtained the exclusive agency right of Subaru in eight provinces and cities in China, becoming the largest distributor of Subaru in China; In 2011, Pang Da Group signed a regional sales agency agreement with South Korea Shuanglong Automobile Group to set up agency companies in 21 regions of China; In June of the same year, through the wholly-owned acquisition of Babs International Holdings (Hong Kong) Co., Ltd., Pangda Group became the sales agent of Mercedes-Benz car modification brand Babs in China for 20 years at a purchase price of about 200 million yuan; since then, Pangda Group has also reached strategic cooperation with ultra-luxury car brand Aston Martin, becoming the latter's largest dealer partner in China.

Although the early huge group itself "qualification" is excellent, but a few years later, the huge group was suspected of violating securities laws and regulations by the CSRC investigation, this year (2017) the huge group also began to decline, performance collapsed year by year. Since 2017, the huge group has encountered liquidity shortage difficulties, and in 2019, it directly fell into huge losses. According to the data, from 2017 to 2019, the non-profit deduction of the huge group was-2.09 billion yuan, -68.41 billion yuan and-4.052 billion yuan respectively. At that time, the huge group said that the reason for the serious damage to its performance was due to factors such as large fluctuations in the market environment and continuous fermentation of company investigation events, and some financial institutions took tight credit measures to aggravate the shortage of funds. The shortage of funds further affected the purchase volume, and at the same time, it was eager to realize inventory and sell some vehicles with longer stock age at a discount, resulting in an increase in operating costs and a decrease in gross profit.

Despite the positive response measures taken by the huge group during these years, the decline in performance for several years also led to the insolvency of the huge group, which was finally declared bankrupt and restructured in May 2019 and completed bankruptcy reorganization in December of that year, but the reorganization was still powerless after three years. * ST giant has repeatedly announced repurchase or increase plans to seek "shell protection", but failed to complete on schedule, now to the edge of delisting is sobering.

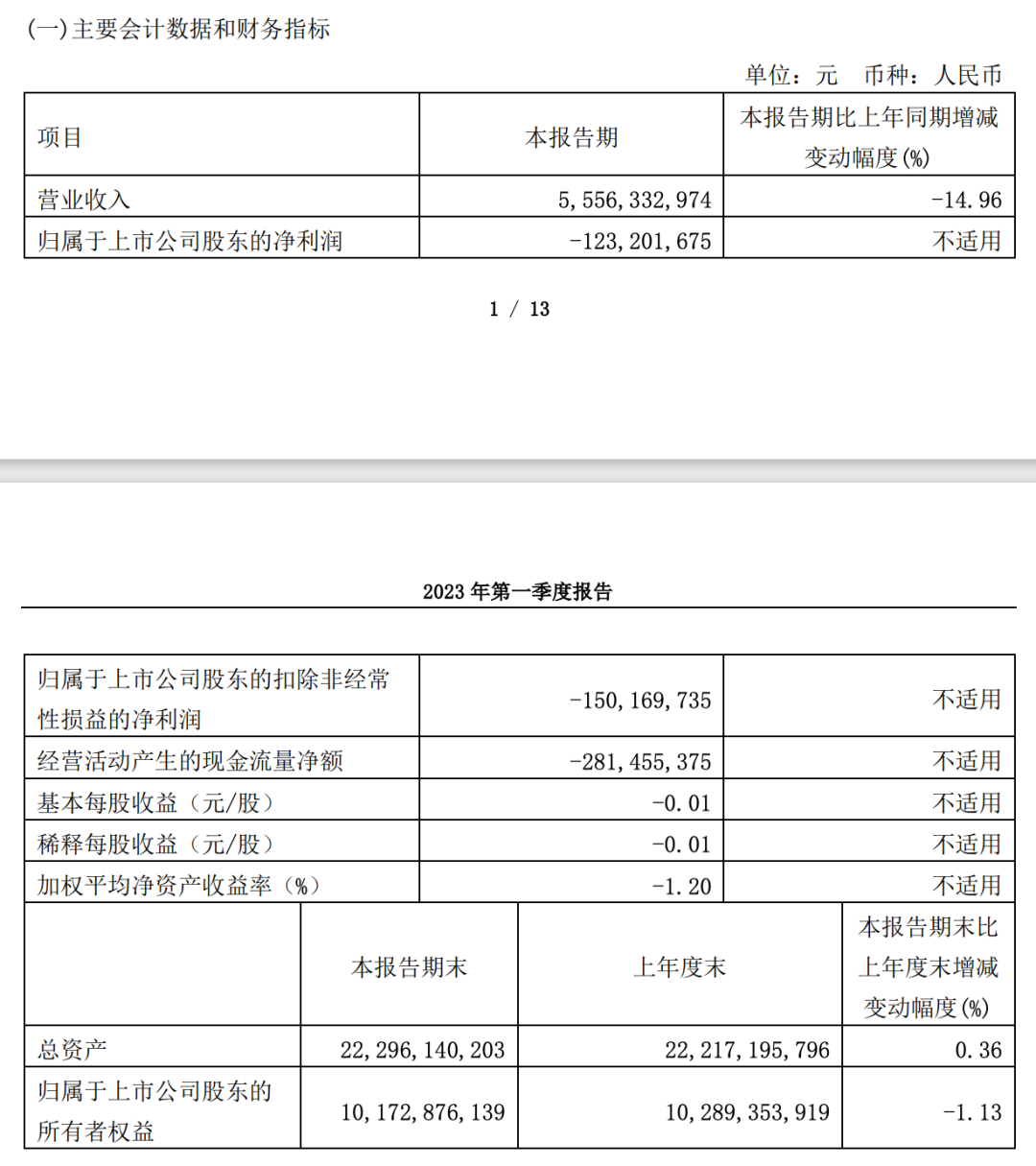

Now, the performance of the huge group has completely collapsed. According to the financial report, in 2022, the huge group lost 1.441 billion yuan again, leaving only 267 distribution stores; in the first quarter of 2023, the huge group lost 123 million yuan. In addition, due to the continuous negative net cash flow from operating activities, the failure to collect large receivables, bankruptcy reorganization of due debts and other problems, the accounting firm issued an audit report that could not express opinions.

In addition to the collapse of performance, there have been frequent changes at the top of the huge group. * ST Huge announced that on April 29, Huang Jihong was removed from the post of President by the Board of Directors; on May 19, Liao Zhaohui resigned as a director of the Company and a member of the Strategy Committee of the Board of Directors due to personal reasons, and no longer held any position in the Company after resignation.

The delisting of the huge group that keeps issuing delisting risk warning has been "fixed." According to "Automobile Industry Concern," the huge group may be only a miniature of many automobile dealers from the former "first share of automobile dealers" to the current delisting. According to the Survey Report on the Survival Status of National Automobile Dealers in 2022 issued by China Automobile Circulation Association, the proportion of dealers losing money in 2022 is 45.2%, which is 27.7% larger than that in 2021.

At present, the total market value of the huge group has dropped from the highest 55.8 billion yuan in 2015 to 4.295 billion yuan, and the market value has evaporated by more than 50 billion yuan.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.