In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-07-27 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)05/27 Report--

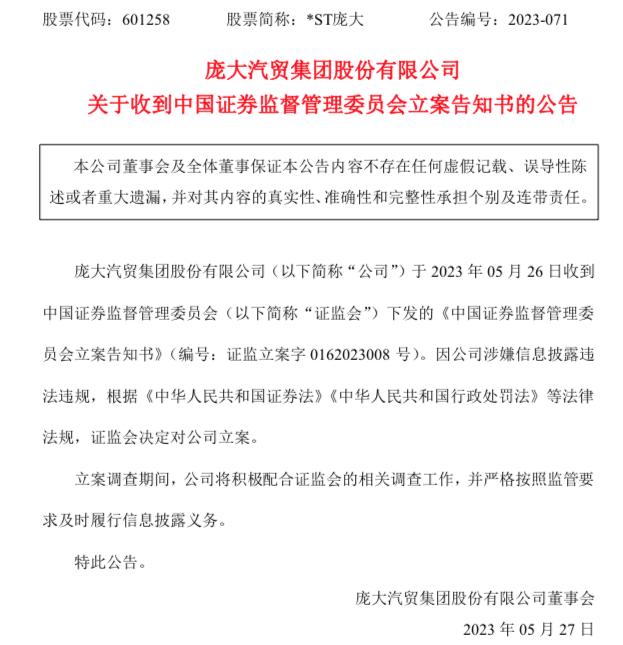

On May 27th, * ST announced that Giant Automotive Trade Group Co., Ltd. (hereinafter referred to as "the Company") received the China Securities Regulatory Commission (CSRC) notice on filing a case issued by the China Securities Regulatory Commission (CSRC) on May 26, 2023 (serial number: CSRC filing No. 0162023008). Because the company is suspected of violating the laws and regulations of information disclosure, the CSRC has decided to file a case against the company in accordance with laws and regulations such as the Securities Law of the people's Republic of China and the Administrative punishment Law of the people's Republic of China. During the period of filing the case for investigation, the company will actively cooperate with the relevant investigation work of the CSRC and fulfill the obligation of information disclosure in time in strict accordance with the regulatory requirements.

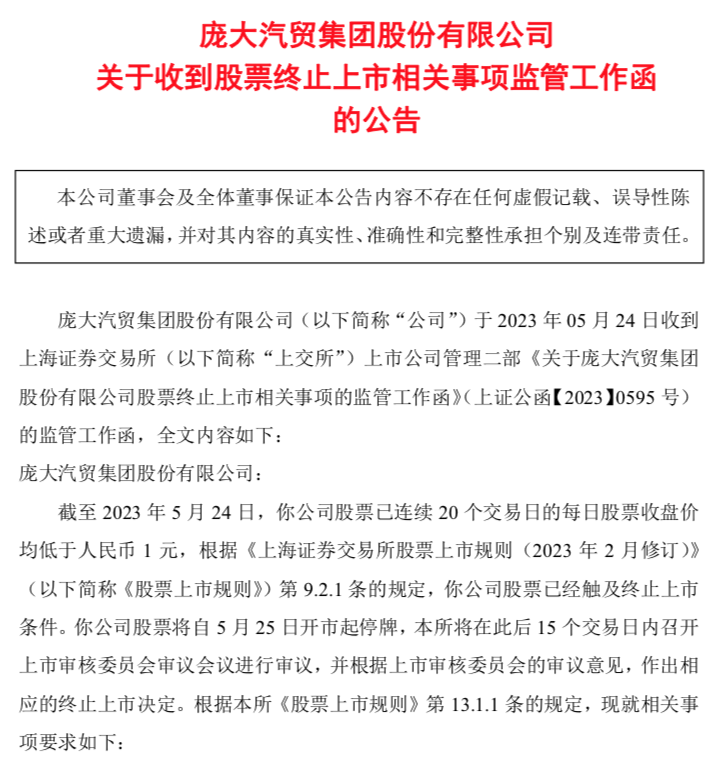

At the same time, shares of the giant group were suspended from trading on May 25, and the Shanghai Stock Exchange will issue advance notice to the company of plans to terminate the listing of its shares within five trading days after the company touches the delisting of the trading class. The giant group first issued a "risk warning notice on the possible termination of the listing of shares" on April 22, indicating that the company was at risk of delisting. From May 11 to May 24, the huge Group issued 10 risk reminders of the possible termination of the listing of shares, reminding investors of the risk of being terminated.

On May 25th, * ST disclosed in its announcement that Giant Group received a regulatory work letter from the second Department of Management of listed companies on the Shanghai Stock Exchange on matters related to the termination of the listing of the shares of Giant Automobile Trading Group Co., Ltd. (Shanghai official letter [2023] No. 0595) on May 24, 2023. According to the regulatory work letter, as of May 24, 2023, the daily closing price of Giant Group shares has been less than RMB 1 for 20 consecutive trading days. According to the Stock listing rules, Giant Group shares have reached the conditions for termination of listing. Giant Group shares will be suspended from the opening of the market on May 24, and the Shanghai Stock Exchange has decided to terminate the listing of Giant Group shares in accordance with relevant regulations.

This also means that the former "king of 4S stores" is about to bid farewell to A-shares and powerless. As once the largest automobile dealer group in the country, it had more than 1000 automobile 4S stores in the early days, and its market capitalization at the beginning of listing reached 36 billion yuan, making it the "first stock in China's auto trade". However, from the point of view, the huge groups with excellent "qualifications" in the early days are now not only on the verge of delisting, but also facing collapsing performance, operating outlets and declining car sales.

Huge Group was established in March 2003, founded by Pang Qinghua, is a national automobile sales service-based large car dealer group, the main products include passenger cars and commercial vehicles, mainly to distribute mainstream joint venture brands.

In April 2011, the giant group was officially listed on the Shanghai Stock Exchange, becoming the first domestic automobile trade group to log on to A-shares through IPO. Against this backdrop, large groups have embarked on a radical path of global expansion. In 2004, the giant group set up Subaru's largest 4S store in Asia in Beijing Wufang Bridge, and established Zhongji Subaru as the sole proprietorship of the giant automobile trade group. since then, through its subsidiary Zhongji Subaru, it has obtained the exclusive agency of Subaru in eight provinces and cities in China, becoming Subaru's largest dealer in China. In 2011, Giant Group signed a regional sales agency agreement with South Korea Ssangyong Automobile Group to set up agency companies in 21 regions in China. In June of the same year, through the wholly-owned acquisition of Babos International Holdings (Hong Kong) Co., Ltd., Giant Group became the sales agent of Mercedes-Benz car retrofit brand Babos in China for 20 years, with a purchase price of about 200 million yuan. Giant Group also reached a strategic cooperation with ultra-luxury car brand Aston Martin to become the latter's largest dealer partner in China.

Data show that from 2009 to 2011, the group's total revenue was 35.2 billion yuan, 53.8 billion yuan and 55.6 billion yuan, among which Chao Guanghui Automobile became the champion of car dealers in China in 2009. In 2011, it became the first domestic automobile trade group to log on to A shares through IPO. After listing, the total market capitalization once reached 55.8 billion yuan. The following year, it operated as many as 1429 outlets and 754 4S stores. But in a few years, the huge group was filed for investigation by the Securities Regulatory Commission on suspicion of violating securities laws and regulations, and from this year (2017), due to the impact of the tight capital chain caused by excessive expansion, the huge group began to decline and its performance collapsed year by year.

After a series of announcements about the sale of some assets, equity pledge and senior executive holdings, large groups suffered liquidity shortages in 2017, plunged directly into huge losses in 2019, and then became unable to repay their debts due to a funding gap. According to the data, from 2017 to 2019, the group deducted non-net profits of-2.09,68.41 and-4.052 billion yuan respectively. At that time, the large group said that the serious damage to performance was due to factors such as the volatility of the market environment and the continuous fermentation of the company's case investigation, and some financial institutions took credit tightening measures to aggravate the capital shortage. The shortage of funds further affects the purchase volume, and at the same time, it is eager to cash in inventory and sell some older vehicles at a discount, resulting in an increase in operating costs and a decline in gross profit.

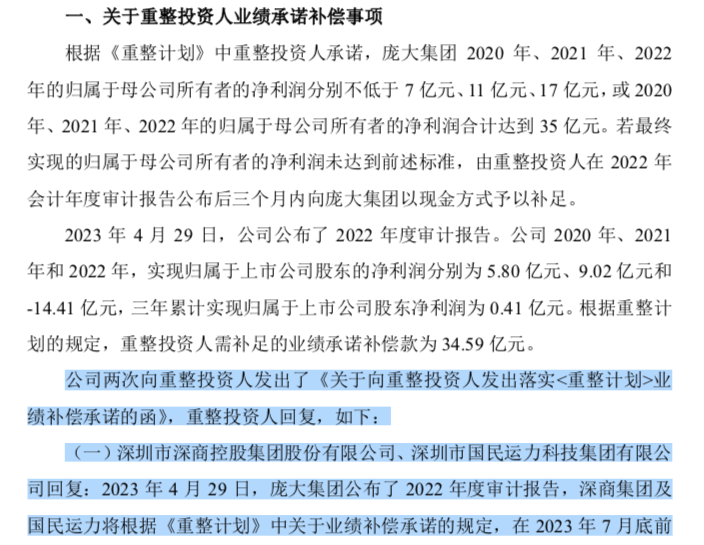

Despite the positive response taken by the large group during these years, the successive years of declining performance also led to the insolvency of the large group, which was finally declared bankrupt in May 2019 and completed in December of that year. In the reorganization plan, the restructuring party promised to adjust the business structure of the large group to ensure that the large group would restore sustainable profitability, and promised that the net profit belonging to the parent owner of the giant group in 2020, 2021 and 2022 would not be less than 700 million yuan, 1.1 billion yuan and 1.7 billion yuan, respectively, or the total net profit belonging to the parent owner in 2020, 2021 and 2022 would reach 3.5 billion yuan. But in the end, the giant group failed to meet its expected performance commitments. The data show that from 2020 to 2022, the huge group achieved revenue of 27.386 billion yuan, 28.633 billion yuan and 26.02 billion yuan respectively, net profit of 580 million yuan, 898 million yuan and-144 million yuan respectively, and net profit of 187 million yuan,-389 million yuan and-155 million yuan respectively. In terms of sales volume, vehicle sales were 141,000, 1414,400 and 129,800 respectively.

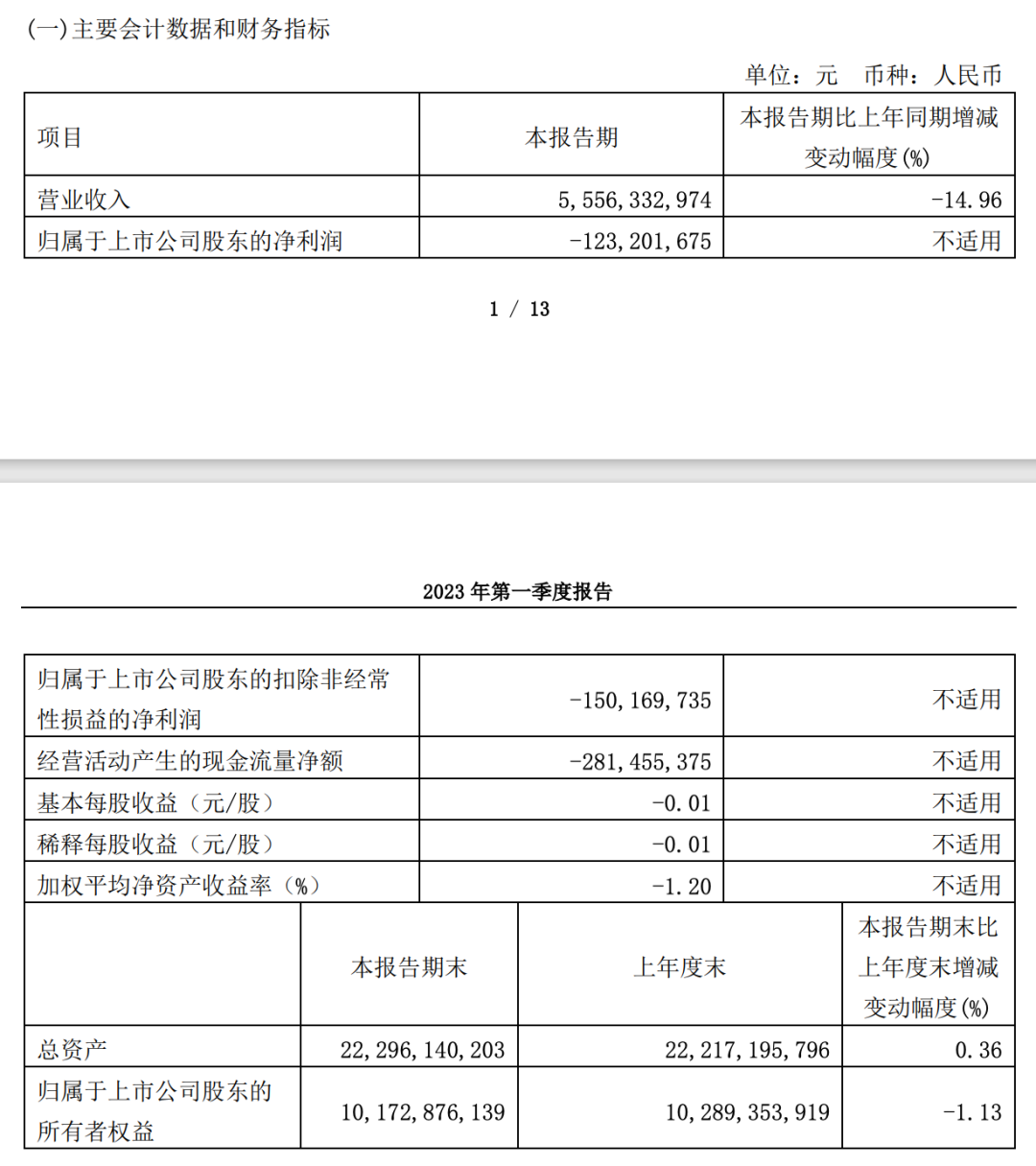

It has been three years since the restructuring, but the huge groups are still powerless. For now, the performance of the giant groups has completely collapsed. The financial report shows that in 2022, the giant group lost another 1.441 billion yuan, leaving only 267 distribution stores; in the first quarter of 2023, the giant group lost 123 million yuan. In addition, because the net cash flow of operating activities continues to be negative, large amounts of receivables are not recovered, bankruptcy restructuring due debts and other problems, large groups have been issued by accounting firms can not express their opinions on the audit report.

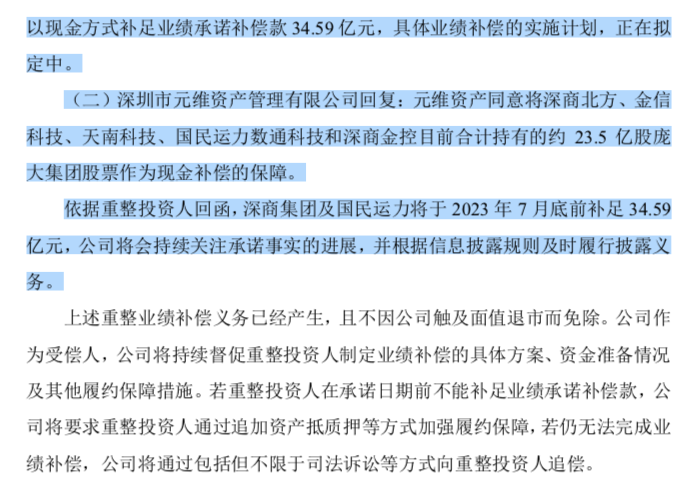

In addition to the collapse of performance, since May, the giant group has successively disclosed such information as "regulatory letter reply", "shareholder meeting cancellation", and "director resignation". To some extent, these information has released the worrying situation of the huge group. * ST announced that Huang Jihong was removed from his post as president by the board of directors on April 29th. On May 19th, Liao Chaohui resigned as a director of the company and a member of the board's strategy committee for personal reasons, and will no longer hold any position in the company after his resignation. In addition, according to the provisions of the reorganization Plan, the giant group did not meet the performance commitment standards of the restructuring investors. the previous announcement showed that the compensation for the performance commitments to be made up by the restructuring investors was 3.459 billion yuan. The giant group has twice issued a "letter on the implementation of performance compensation commitments to restructuring investors". Restructuring investors will trigger performance compensation this year, but so far It will take more time to tell whether the compensation will be received as scheduled.

Auto Industry concern believes that the huge group from the former "first share of car dealers" to now on the verge of delisting may be just a microcosm of many car dealers. According to the National Automobile Dealers Survival Survey report 2022 released by the China Automobile Circulation Association, 45.2 percent of dealers lost money in 2022, an increase of 27.7 percent over 2021.

Today, the total market capitalization of the giant group has dropped from a peak of 55.8 billion yuan in 2015 to 4.091 billion yuan, with the market capitalization losing more than 50 billion yuan. As of the opening of the market on May 25, the shares of huge groups have been suspended, and delisting is almost an inextricable fate for huge groups. Although delisting does not mean that huge groups will go bankrupt or collapse, the huge road of bankruptcy and reorganization has not been successful at present. Reorganization may be the key point that really determines the survival of huge groups.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.