In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-01 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)06/01 Report--

On May 31, brilliance China announced that the company had been informed by brilliance Manager that Shenyang Automobile Co., Ltd. had been selected by the brilliance Group restructuring Investor selection and Review Committee as a potential investor in brilliance restructuring, and that brilliance restructuring plan was still being worked out, pending approval from brilliance creditors' meeting and Shenyang Intermediate people's Court.

Data show that Shenyang Automobile Co., Ltd. was established in February 2023, the legal representative Liu Yanhui, the company's registered capital of 500 million yuan, is a wholly-owned subsidiary of Shenyang Cairui Investment Co., Ltd. the latter is finally controlled by the State-owned assets Supervision and Administration Commission of the Shenyang Municipal people's Government.

Earlier, it was rumored that the Shenyang municipal government was discussing the possible acquisition of a 30 per cent stake in brilliance china, which is in the process of bankruptcy restructuring, in order to indirectly own BMW brilliance, a joint venture owned by brilliance china. The Shenyang municipal government is also considering eventual control of brilliance China, but the acquisition of 30 per cent or more of the shares in Hong Kong-listed companies would trigger a mandatory and unconditional offer to buy the remaining shares, and buyers can apply for exemption from market regulators, according to people familiar with the matter.

In response to the news, brilliance China issued an announcement in response: recently, there have been a number of media reports that the Shenyang municipal government may acquire shares in the company from brilliance Automobile Group holding Co., Ltd. (the controlling shareholder of the company, through its wholly-owned subsidiary Liaoning Xinrui Automotive Industry Development Co., Ltd., which actually holds about 30.43% of the issued share capital of the company and is now undergoing restructuring). The Board would like to clarify that to the best of the Company's knowledge, knowledge and belief after making all reasonable enquiries, the Company is not aware of the matters reported in the media and the source of the information contained therein.

From the point of view of the time of establishment, Shenyang Automobile may be set up for the local government to restructure brilliance Motor, and the possibility of subsequent relevant arrangements by the local government can not be ruled out.

Brilliance Automobile Group holding Co., Ltd. is a large vehicle manufacturing enterprise controlled by Liaoning SASAC, which directly or indirectly controls and participates in four listed companies. and through its listed company brilliance China Automobile Holdings Co., Ltd. and BMW Group Joint Venture established brilliance BMW Co., Ltd.

In November 2020, the Shenyang Intermediate people's Court ruled to accept the creditor's application for the reorganization of brilliance Automobile Group holding Co., Ltd., marking that the car company has officially entered the bankruptcy reorganization process. In March 2021, the Shenyang Intermediate people's Court ruled that 12 enterprises including brilliance Group should be tried by substantive merger and reorganization, and appointed the manager of brilliance Group as the substantive merger and reorganization manager of 12 enterprises, including brilliance Group.

At present, brilliance Group's largest joint venture in China is brilliance BMW, which is also the main source of group income, in addition to brilliance China, brilliance Renault and other brands, but from the company structure, the current brilliance vehicle business except brilliance BMW, the rest has basically disappeared.

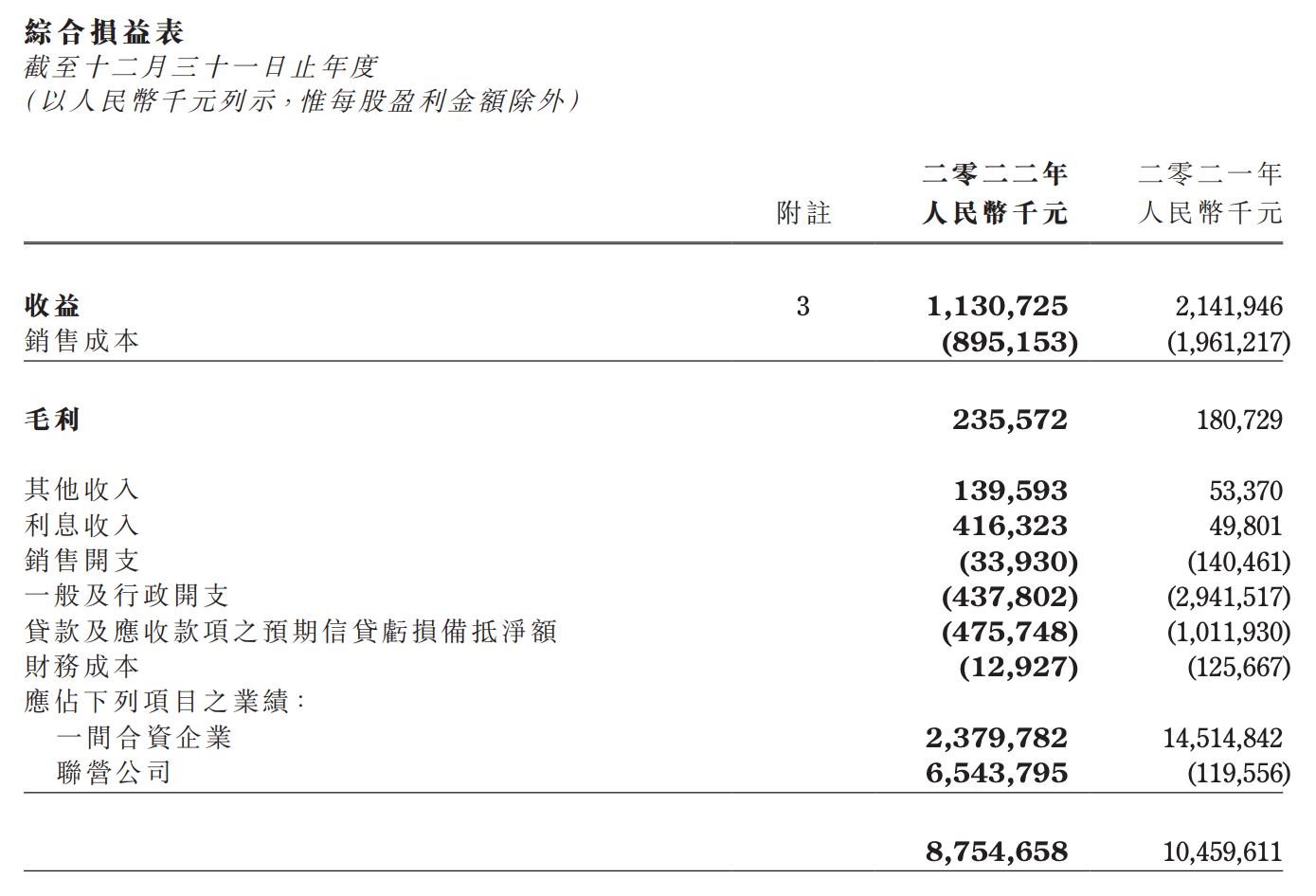

In May 2003, brilliance China Automobile Holdings Co., Ltd. and BMW Group jointly established brilliance BMW Motor Co., Ltd., each holding 50%. The decline of brilliance Group has also given BMW an opportunity to take advantage of its new license. BMW Group's shareholding in brilliance BMW has increased from 50% to 75%. This also marks that BMW will have more decision-making power in the operation of the joint venture. Brilliance's influence will be further weakened, and its profits from the joint venture will be greatly reduced, which will undoubtedly aggravate the group's financial crisis. The net profit contributed by brilliance BMW fell by 83.6 per cent to 2.38 billion yuan in 2022 from 14.515 billion yuan in 2021, mainly due to the reclassification of BMW brilliance from a joint venture into an associate after the sale of 25 per cent equity interest in BMW to BMW took effect in February 2022.

At present, brilliance is still in a state of restructuring, and it is still unknown who will become brilliance's white guard, but as a large vehicle manufacturer and as a partner of BMW Group, brilliance will not "die". However, after losing control of brilliance BMW, it has been difficult to return to China's mainstream auto market. In such a cruel market, it will never be kind to any company because of its aura, and even with the BMW brand for a hundred years, brilliance seems to have entered its twilight years.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.