In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-07-27 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)06/21 Report--

New energy vehicles once again ushered in major good news. On June 21, the Ministry of Finance, the State Administration of Taxation and the Ministry of Industry and Information Technology jointly issued the announcement on extending and optimizing the tax reduction and exemption Policy for the purchase of New Energy vehicles.

The announcement points out that new energy vehicles purchased from January 1, 2024 to December 31, 2025 will be exempted from vehicle purchase tax, of which the tax allowance for each new energy passenger vehicle shall not exceed 30, 000 yuan; the vehicle purchase tax will be halved for new energy vehicles purchased from January 1, 2026 to December 31, 2027, of which the tax reduction for each new energy passenger vehicle shall not exceed 15000 yuan.

At present, the domestic vehicle purchase tax is calculated as follows: the deduction amount = 10% * [ticket price / (1 + VAT 13%)]. The quick calculation method provided by 4S stores to consumers is "vehicle fare / 11.3". Take a new energy vehicle with an invoice price of 150000 yuan as an example, the vehicle purchase tax can be reduced to 13200 yuan.

With the announcement of this announcement, it means that the vehicle purchase tax exemption policy for new energy vehicles originally scheduled to expire at the end of this year will continue to be exempted in accordance with the original policy, while the exemption line for new energy vehicles in 2024 and 2025 will be "including tax price of 339000 yuan (3: 11.3 to 33.9)", that is, new energy vehicles with a tax price of 339000 will be exempted, and vehicles with a price of more than 339000 will be taxed at 10%.

According to the red line setting of "tax allowance of no more than 30,000 yuan per new energy passenger vehicle" in the above latest announcement, from 2024 to 2025, only new energy passenger vehicles with a ticket price of less than 339000 yuan can fully enjoy the vehicle purchase tax policy, while new energy passenger vehicles with ticket prices exceeding 339000 yuan will be subject to vehicle purchase tax, which will be levied at 10%. Take a new energy passenger car with a ticket price of 400000 yuan as an example, the excess of 61000 yuan will have to pay a vehicle purchase tax of 5398 yuan. In addition, from 2026 to 2027, new energy passenger cars with fares below 169500 yuan (inclusive) will be fully entitled to the vehicle purchase tax exemption policy.

Or under the influence of the above positive policies, auto stocks are also boosted today. By the midday close, NIO-SW (09866.HK), Xiaopeng Automobile-W (09868.HK) and ideal Automobile-W (02015.HK) were up 5.10%, 3.41% and 3.23% respectively, while the A-share auto sector was up 1.21%.

It is understood that the policy of exemption from purchase tax for new energy vehicles began as early as September 2014 and was originally planned to expire in 2017, but in view of the positive impact of this policy on the development of the domestic new energy vehicle market, it was extended by three years in 2018 and two years in 2020. In September last year, the three departments jointly issued a document to extend the vehicle purchase tax exemption policy for new energy vehicles, which were purchased during the period from January 1, 2023 to December 31, 2023.

According to the State Administration of Taxation, a total of about 5.681 million new energy vehicles enjoy the purchase tax exemption policy in 2022, with a total tax exemption of 87.9 billion yuan, an increase of 92.6 percent over the same period last year. Xu Hongcai, vice minister of the Ministry of Finance, said earlier that it was initially estimated that with the extension policy, the total amount of vehicle purchase tax relief from 2024 to 2027 would reach 520 billion yuan.

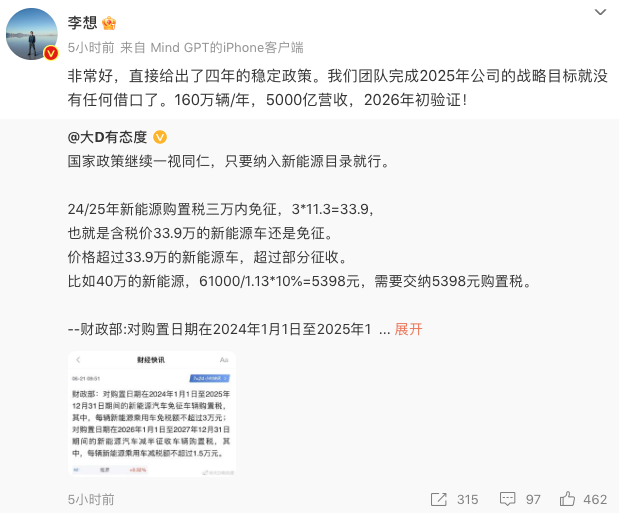

In response to the "new energy vehicle purchase tax exemption will continue until 2025, and the tax will be halved in 2026", many car companies CEO also said that the "new deal" is good for the new energy vehicle market.

Ideal car CEO Li Xiang said on his personal Weibo: "the 'New deal' is very good and directly gives a four-year stability policy." There is no excuse for our team to achieve the company's strategic goal of 2025. 1.6 million vehicles per year, 500 billion revenue, verified at the beginning of 2026! " According to the official website, ideal cars are currently on sale, including ideal L7, ideal L8 and ideal L9, with a price range of 319800 yuan to 459800 yuan, which means that starting from next year, users will have to pay new energy vehicle purchase tax for models with a price of more than 339000.

Zhang Yong, co-founder of Nezha Automobile and CEO, also said: "the New deal will help stabilize expectations, stabilize consumption, and further stimulate the expansion of the new energy vehicle market." In addition, as a representative of the head brand of new energy vehicles, BYD also said that the new deal is a major good policy for the industry, which is conducive to stabilizing industry expectations, strengthening confidence, and giving full play to the role of "ballast stone" and "power source" in the new energy vehicle market. For automobile enterprises, because the development cycle of new energy vehicles is long, after the introduction of policies, we can better make medium-and long-term planning and arrangements in product development, design, cost management and so on. BYD did not respond positively to whether the policy limit would affect its high-end models.

Cui Dongshu, secretary general of the Federation of passengers, said: "the policy of 'two exemptions and two reductions' of the purchase tax on new energy vehicles does not have much impact on the car market this year, but because it is the purchase tax of new energy vehicles' two exemptions and two reductions', it has a certain policy stability and is good for new energy vehicles in the long term. It is expected to reach a peak of nearly 200 billion of the annual tax exemption scale, and the strong tax exemption reflects the higher-than-expected national policy support."

At present, the development of China's new energy vehicle industry continues a good trend. According to the data, the domestic production and sales of new energy vehicles in 2022 were 7.058 million and 6.887 million respectively, an increase of 96.9% and 93.4% respectively over the same period last year, with a market share of 25.6%, making it the world's largest new energy vehicle market for eight consecutive years. From January to May 2023, the production and sales of new energy vehicles were 3.005 million and 2.94 million respectively, an increase of 45.91% and 46.8% respectively over the same period last year, with a market share of 27.7%. Ye Sheng Jibi, deputy secretary-general of the China Association of Automobile Manufacturers, said that the continuation of the vehicle purchase tax exemption policy for new energy vehicles will play a very important role in promoting the growth of the new energy vehicle market. Especially after the official withdrawal of the "national subsidy" of new energy vehicles this year, the cost pressure of terminal products and the challenges faced by the market development are getting bigger and bigger, and the supporting role of the vehicle purchase tax exemption policy is particularly important.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.