In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-07-27 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)07/26 Report--

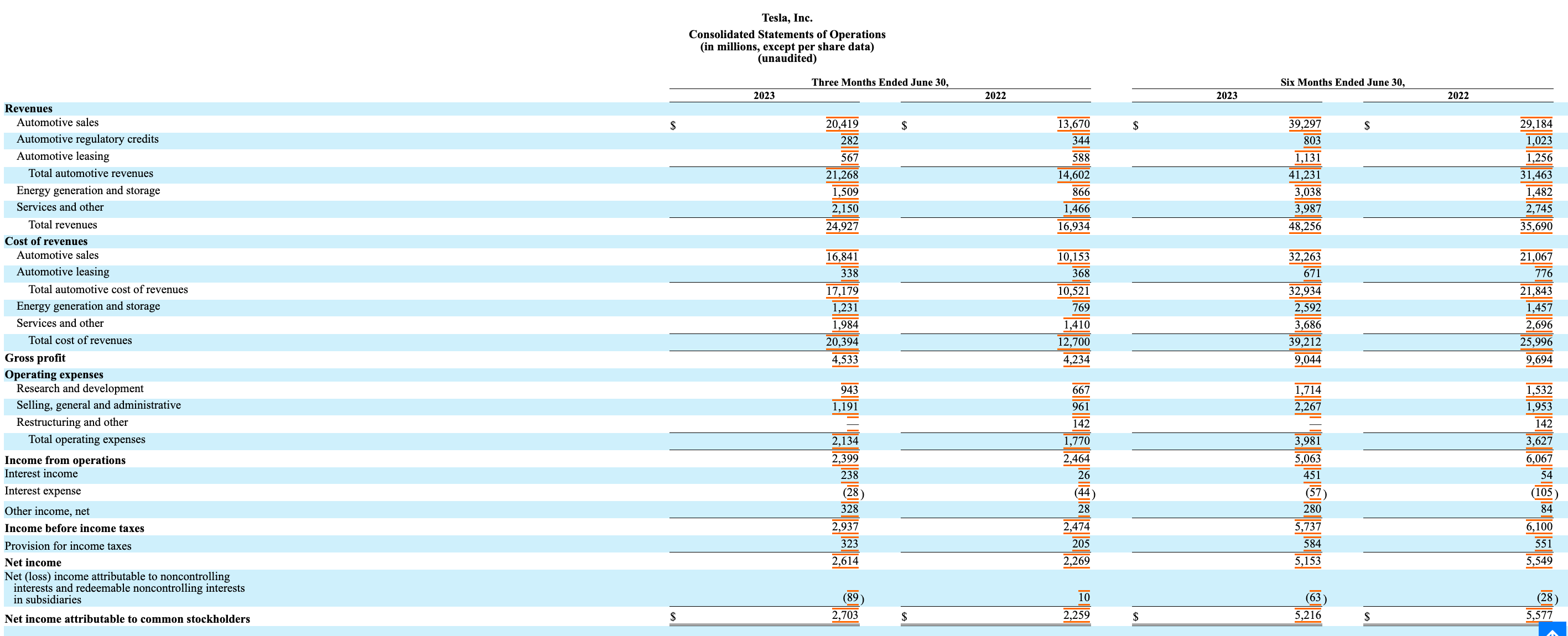

Tesla filed a document with the Securities and Exchange Commission (SEC) on July 24, local time, disclosing the company's operations in the second quarter of 2023. In the second quarter of 2023, the company achieved operating revenue of $24.927 billion, up 47.2 percent from a year earlier, according to the documents. Net profit was 2.703 billion US dollars, an increase of 19.81 percent over the same period last year.

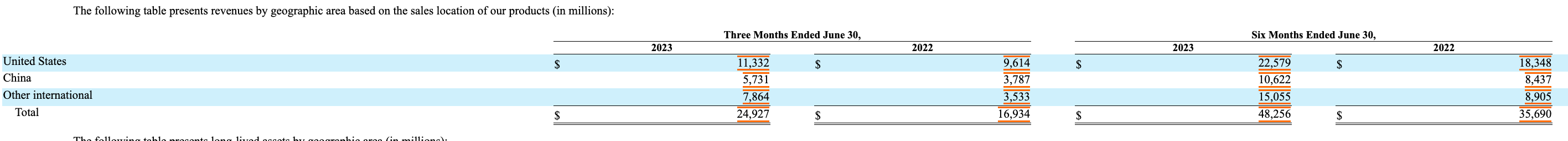

Regionally, the US remains Tesla's world's largest market, with revenues of $11.332 billion in the second quarter, up 17.87 per cent from $9.614 billion last year and accounting for 45.5 per cent of the company's total revenue. Revenue in the Chinese market was $5.731 billion, up 51.33% from a year earlier, accounting for 23.0% of the company's total revenue. In addition, revenue from other markets was $7.864 billion, up 122.59 per cent from a year earlier.

In terms of sales volume, Tesla delivered a total of 466100 electric vehicles in the second quarter, the highest quarterly delivery since the founding of Tesla, an increase of 83.0% over the same period last year, of which 446900 were delivered by Model 3Unip Y and 19200 by Model Splink X. In the first half of 2023, Tesla delivered a total of 889000 vehicles, an increase of 57.4% over the same period last year.

Tesla's share of the Chinese market has risen compared with 2022. On the one hand, the Chinese auto market was affected by the epidemic in the second quarter of 2022, with a strong low base effect. On the other hand, price reduction is still the main means for Tesla to enhance his competitiveness, with retail sales of 294100 vehicles in the Chinese market in the first half of the year, an increase of 48.9% over the same period last year.

Sales growth led to revenue growth, but this was obtained by Tesla through price reduction. Since the beginning of this year, Tesla has announced price cuts in many markets around the world. this strategy is obviously effective. The decline in sales prices has brought considerable market performance to Tesla, but it has also made Tesla less and less profitable. Due to price cuts and increased discounts in the second quarter to reduce inventory, Tesla's gross profit margin in the second quarter was only 18.2%, the lowest level in 16 quarters. It is understood that since the delivery scale of Model S and Model X began to increase in 2015, Tesla's gross profit margin on car sales has rarely been lower than 18%, only in the second quarter of 2018 (16.5%) and the fourth quarter of 2019 (17.7%).

For Tesla, before the emergence of low-cost electric cars, price for quantity is still the main means of sales, and the possibility of further price reduction in the future will not be ruled out. Musk said at the earnings conference that the value of cars with self-driving will soar in the near future, and the only concern in the short term is how to get enough money to reinvest, and the company cannot control the macroeconomic environment. If the macro environment is volatile, pricing will have to be reduced.

In order to complete the sales strategy for the whole year, it is obvious that Tesla is willing to make some concessions on pricing. Musk said that short-term gross profit margin fluctuations and profitability changes actually have little impact on Tesla, and with the advent of the era of automation, there is no point in worrying about these figures. Tesla can achieve long-term goals, but cannot control short-term unrest.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.