In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-07-27 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)10/10 Report--

According to the national enterprise bankruptcy reorganization case information network, Weima Automotive Technology Group Co., Ltd. applied for bankruptcy review, and the handling court was the Shanghai third Intermediate people's Court.

Weima Automotive Technology Group Co., Ltd., the operating entity company of Weimar Automobile, was established in May 2012 and is wholly owned by Suzhou Weimar Wisdom Travel Technology Co., Ltd. the founder is Shen Hui, former vice president of Geely Holdings Group, senior vice president of Volvo and chairman of Volvo China. According to the heavenly eye, Weima Automotive Technology Group Co., Ltd. has been executed for a total of 109 million yuan.

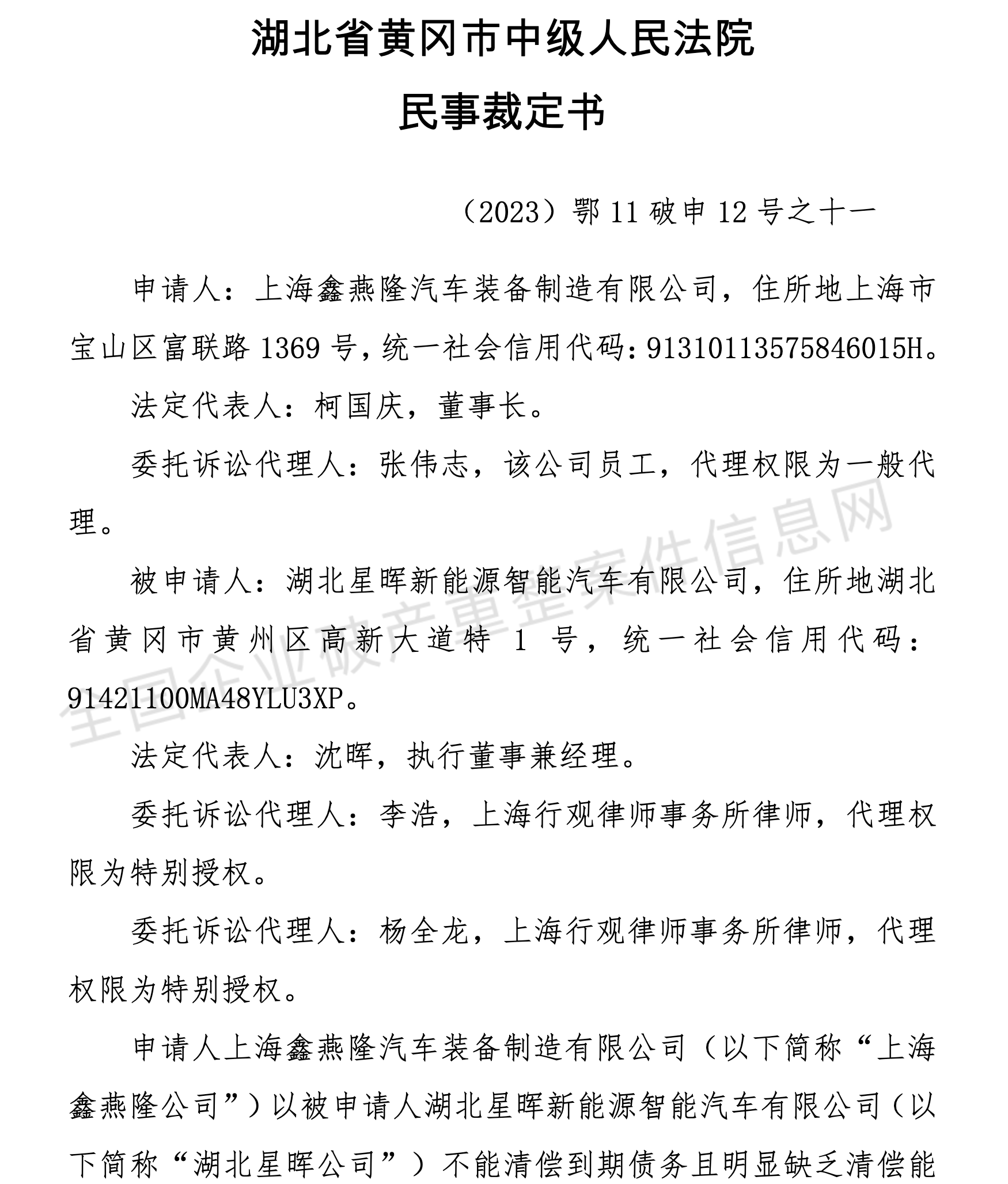

Earlier, Hubei Xinghui New Energy Intelligent Automobile Co., Ltd., an entity company of Weima Automobile Huanggang Factory, was also filed for bankruptcy examination. The applicant was Shanghai Xinyanlong Automotive equipment Manufacturing Co., Ltd., after hearing and investigating, the court decided to accept the bankruptcy reorganization application of Shanghai Xinyanlong Automotive equipment Manufacturing Co., Ltd. against Hubei Xinghui New Energy Intelligent Automobile Co., Ltd. The court held that a large number of maturing debts of Hubei Xinghui Company have not been paid off after the maturity, and Hubei Xinghui Company has stopped production for nearly a year, and a large number of employees' wages, social security fees and taxes have not been paid. It can be concluded that Hubei Xinghui Company obviously lacks the ability to pay off its debts.

At present, the living condition of Weimar is very worrying. Weima is facing a huge crisis in the three main operation links of production, sales and after-sales service. In terms of production, the Weima factory is in a state of suspension, and the on-the-job employees can only get a basic salary of 1700 yuan a month to survive because of no performance. In terms of sales, Beijing, Shanghai, Chengdu and other places closed stores in large areas, because no consumers are willing to buy Weima models, resulting in dealers facing double difficulties, more and more dealers choose to withdraw from the network and turn to other car brands. In terms of after-sales, the closure of a large area of stores makes it difficult for car owners to maintain, coupled with the suspension of production at the Weima factory and the failure to pay the suppliers in time, the car owners are unable to enjoy after-sales service, and an accessory has to wait for months.

Behind all this, it is because the capital chain is broken. In order to solve the funding problem, Weimar has sought to list IPO several times, through Science and Technology Innovation Board and the Hong Kong Stock Exchange, but failed. In early 2023, Weimar planned to go public by backdoor APOLLO, but the acquisition also ended in failure.

On September 11, Kaixin announced that it had signed a non-binding list of acquisition terms with Weimar and planned to issue a certain number of new shares to acquire the 100% stake in Weimar held by its existing shareholders. Prior to this, Kaixin Motor once set up a new energy vehicle department and entered the development of the minicar market through the acquisition of punk's parent company. Kaixin Motor undoubtedly took a fancy to the qualification and factory of new energy production when it acquired Weima Motors. But the operating condition of Happy Automobile itself is not optimistic, and it has been in a state of loss for many years in a row.

The acquisition of Weima Motor by Kaixin Automobile may reverse this unfavorable situation and compete in the larger mid-range new energy vehicle market. However, after Happy Automobile released the relevant news, Weimar's various official channels did not synchronize the news. Perhaps, Weima Automobile is not optimistic about the cooperation between the two sides.

From the point of view of the industry, it seems that it is a wholly-owned acquisition of Weima Automobile, but in fact, Weima Automobile uses the identity of the listing of Happy Automobile's US stocks to plan a backdoor listing. Of course, the smooth completion of the acquisition between the two sides is also full of uncertainty.

At present, Weimar's dilemma is "lack of money", and backdoor listing can save time and costs, and avoid the complex procedures and requirements of listing, which is exactly what Weima needs. Once Weimar Motors successfully arrives in US stocks, the problem of capital shortage will also be easily solved, but the question is who will invest in a car company on the verge of bankruptcy and lack product advantages and technical barriers in the context of increasingly fierce competition in the industry. face market liquidation at any time.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.