In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-01 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)06/19 Report--

Since Dongfeng Yulong's Na Zhijie brand was exposed that it would withdraw from the Chinese mainland market, it was followed and reported by a number of media. In response, Dongfeng Motor said: "Dongfeng Yulong delisting details are being discussed and evaluated, there is no solution."

A few days ago, the media exposed that Taiwan's Yulong Group and Dongfeng Company have reached a preliminary consensus that the Nazhijie brand of the Yulong Group will officially withdraw from the Chinese mainland market. at present, the two sides are still discussing and evaluating the details of Dongfeng Yulong Na Zhijie's withdrawal.

Today, in response to this matter, Dongfeng Motor spokesman Qin Jie said in an interview with the media: "both shareholders are discussing the development of Dongfeng Yulong, and there is no solution at present." That is, after all, the Na Zhijie brand has become one of the plans of Dongfeng Yulong Group to plan a new round of expenditure reduction transformation. If it is delisted, it will become the second joint venture company of Dongfeng Group to delist after Dongfeng Renault this year.

A relevant person in charge of Na Zhijie said that at present, Yulong Group continues to transition to an open platform strategy, the brand is also readjusting its strategy, and the market strategy still lies in the negotiation of shares in the East. We do not rule out the possibility that Na Zhijie will continue to develop with the open platform of the joint venture between Light assets and Hon Hai. However, the Dongfeng Group did not respond to the situation.

Although the delisting has not been officially decided, its Na Zhijie brand has been in the awkward situation of "fewer products and fewer sales" in the current domestic market. There is only one model left for sale in May this year, that is, the medium-sized SUV URX, which went on sale at the end of last year. Dongfeng Yulong sold seven vehicles, down 94.3 per cent from a year earlier, according to the Federation of passengers, while sales in the first five months of this year were only 43, down 92.5 per cent from a year earlier. Obviously, the launch of the new model is still unable to recover its sales difficulties for Na Zhijie.

According to public data, Dongfeng Yulong is a 50% joint venture between Dongfeng Motor and Taiwan's Yulong Group. It was established in December 2010, and its main selling brand is Na Zhijie. During the decade, it has launched eight models, including the URX, U5, you 6 and Da 7 of the SUV model, and the big 7 and MASTER CEO of the car market.

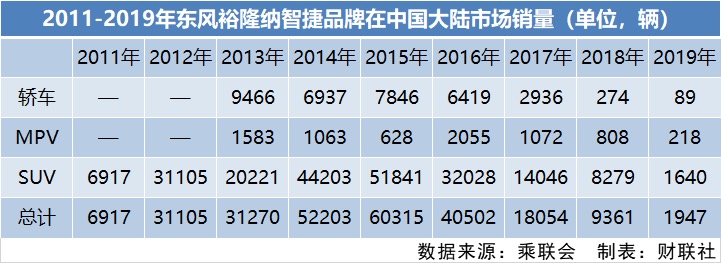

Although Nazhijie is a completely independent brand, but in the domestic market is still in the incremental market, through the joint venture brand price with the configuration of ultra-luxury models, also help it get some market support, reaching a brand peak of 60,000 vehicles by 2015. However, after market verification, its brand began to decline due to the collapse of users' reputation due to the stagnant level of research and development and quality. Sales for the whole of 2017 fell to 17000, down 56 per cent from a year earlier.

In response, Dongfeng Motor Company changed its joint venture and cooperation mode and adopted "withdrawing people without divestment" to Dongfeng Yulong in June of the same year, which made the brand continue to decline, with annual sales falling to 6700 in 2018 and less than 2000 in 2019.

The marginalized Na Zhijie also tried to make changes, changing personnel, dredging sales channels and launching new models, but to no avail. In the view of Cui Dongshu, secretary-general of the Federation of passengers, Na Zhijie, who made an improvement in the SUV model in the early years, did not insist on focusing on this field, but chose to enter the car and MPV market, which did not achieve good performance. With the withdrawal of Dongfeng technology, Na Zhijie's market competitiveness has seriously lagged behind, resulting in the inability to turn around.

It took a long time to launch a new medium-sized SUV model URX at the end of last year, but a media visit to Dongfeng Yulong's Hangzhou production base in June last year found that the company was already in a state of production standstill, so that the model could not be put on the market for a long time, but it was still in the national fifth model after it was put on the market, which obviously could not help the brand to achieve higher sales.

In addition, when the media visited a number of Dongfeng Yulong service outlets, they also found that there was an insufficient supply of after-sales spare parts, resulting in users' vehicles that could not be repaired when they encountered problems, causing a large number of complaints and even selling cars. Even second-hand car dealers do not accept smart vehicles.

With regard to Na Zhijie's failure, an executive who resigned from Dongfeng Yulong revealed that the disunity of voice, the decentralization of power and the resulting management internal friction caused by peer-to-peer ratio are the root causes of Dongfeng Yulong's follow-up development crisis. In the incremental market, Na Zhijie can go up with the trend, making both shareholders have profits, but when the market goes against the trend, the competitiveness of products will be analyzed and solved by internal management, and internal friction is the cause of the problem. for example, product optimization means changing suppliers, but how to choose is still in disagreement between the two sides. Otherwise, Na Zhijie's bad reputation will not continue to this day.

The problem of Na Zhijie brand may be a microcosm of the current automobile market. In the early years, joint venture brands still allowed many brands to increase their profits in the upward market, but with the downward environment of the market, more and more brands reported profits and losses to "negative" news frequently, and even were extremely marginalized, and only some mainstream brands achieved growth. After all, for many years, the most important profits of FAW, SAIC, Dongfeng, Changan and other automobile companies come from joint ventures. With the decline of some joint venture brand advantages, the two sides are prone to differences in product optimization, making it impossible to quickly resolve and introduce product updates, thus reducing its market competitiveness.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.