In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-01 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)01/18 Report--

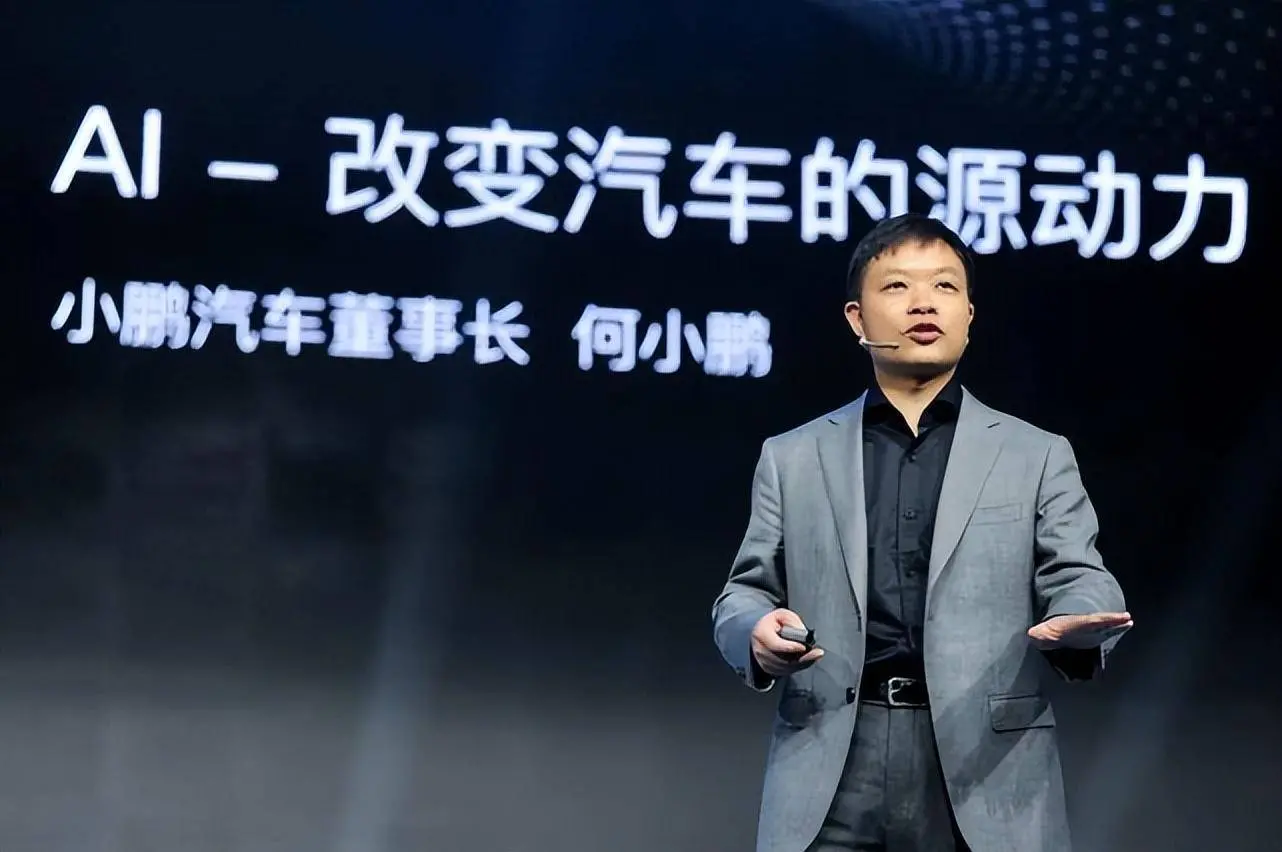

Today, according to media reports, he Xiaopeng said at Xiaopeng's annual wrap-up meeting: he plans to become a regular member of operating profits in 2025. Among them, Xiaopeng Motor's lowest comprehensive gross profit margin is 17% in 2025, and the annual R & D investment reaches the level of 10 billion.

At the same time, Xiaopeng aims to sell 1.2 million cars by 2027, with fully self-driving cars reaching about 30 per cent of the market. He Xiaopeng predicts that the annual sales of new energy vehicles in China may reach 15 million units in 2027, with a market share of about 70 per cent. As for overseas markets, Xiaopeng plans to launch two overseas models in 2023, a third in 2024, and an overseas model in 2025 is currently under discussion.

As for the poor sales figures over the past year, he Xiaopeng said: the changes to the Xiaopeng G9 and P7 in 2022 did not stop the decline in sales, but he thought the G9 and P7 were very successful products, and the decline was only for a moment. In addition, he Xiaopeng also said that 2023, 2024, Xiaopeng G9 and Xiaopeng P7 can make Xiaopeng car return to this track through continuous changes, and become the TOP2 in the subdivision track. In the next platform cycle, each platform of Xiaopeng Automobile can produce different models, and each platform can meet the needs of different customers.

In terms of the team, he Xiaopeng pointed out that there are problems such as the low stock price, sales volume, and morale, the collapse of customer thinking and customer reputation, and the inefficiency of the department caused by Xiaopeng's organizational ability. He Xiaopeng said that he will make a clear strategic plan for the future, put forward higher requirements for the NPS of word of mouth, and abolish the reporting relationship and approval conditions of the general adjudication office, and so on. In fact, after entering 2022, Xiaopeng's sales volume is not ideal. In order to reverse sales, Xiaopeng carried out a deep organizational structure adjustment in October last year, including the establishment of five major committees of strategy, product planning, technology planning, production and marketing, and OTA, and the establishment of three product platform matrixes to ensure that they are customer-oriented and market-oriented, and are responsible for the closed loop of the whole product business end-to-end. At the end of December, according to an internal memo from Xiaopeng, organizational restructuring is continuing, with the establishment of a new financial platform, mainly used to improve the refinement of cost control and the compliance of the financial system.

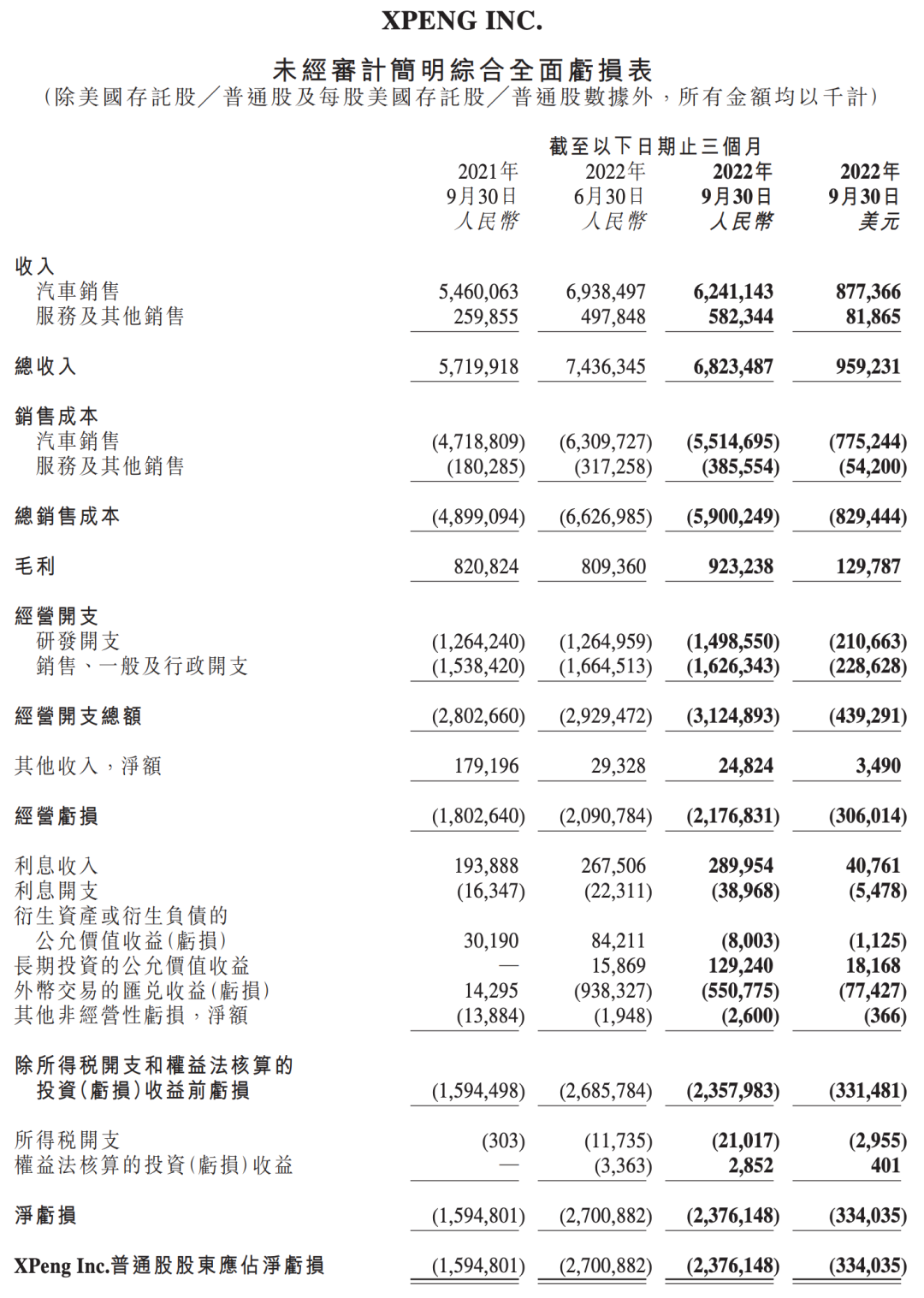

In the context of record sales in the new energy vehicle market, Xiaopeng Motor, like other new car-building forces, is in a state of loss. According to Xiaopeng's third-quarter results, Xiaopeng's revenue in the third quarter was 6.823 billion yuan, an increase of 19.29 percent over the same period last year. The net loss was 2.376 billion yuan, an increase of 48.99% over the same period last year. The gross profit margin was 13.5%, down 0.9% from the same period last year and an increase of 2.6% from the previous month. In the first three quarters of 2022, Xiaopeng Motor lost 6.778 billion yuan in net profit, an increase of 89.54 percent over the same period last year. According to the sales estimate of the same period, Xiaopeng car is equivalent to a loss of more than 68000 yuan per car sold. As of September 30, 2022, Xiaopeng Motor cash and cash equivalents, restricted cash, short-term investment and long-term time deposits are 40.1 billion yuan.

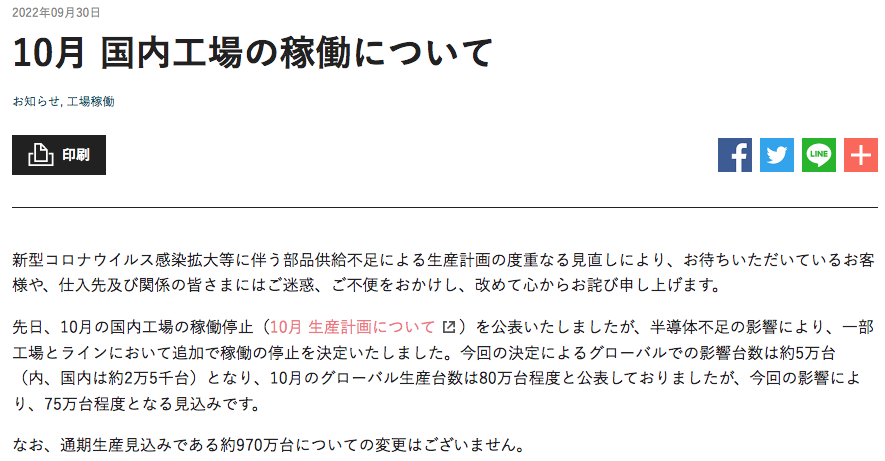

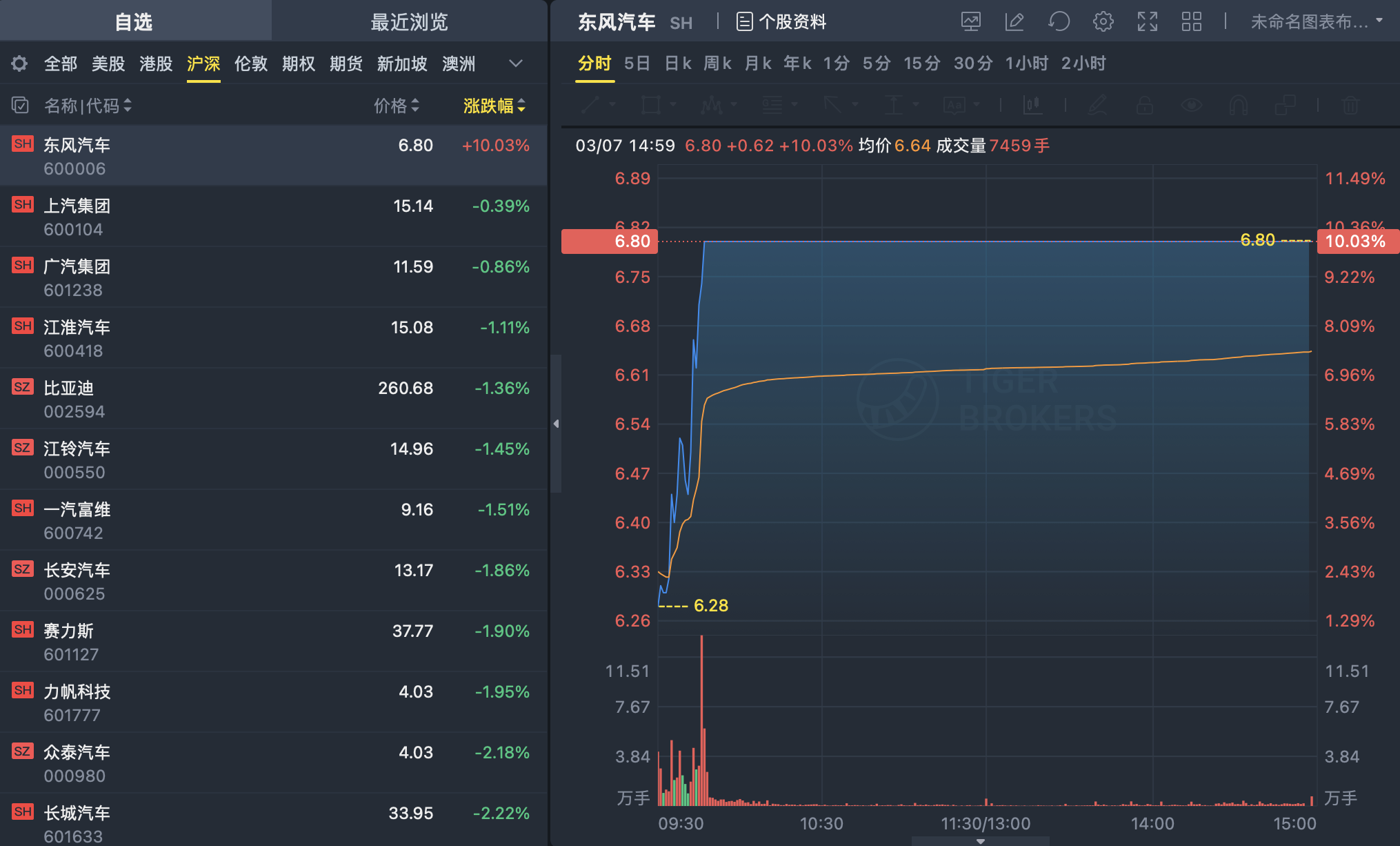

At the present stage, Xiaopeng Automobile is in a situation of "internal and external troubles". It not only has to face the competitive pressure from the new forces of car-building and domestic traditional car companies, but also has to bear the pressure of price reduction brought about by Tesla's recent price reduction. Or due to the recent poor sales, Xiaopeng officially announced a price adjustment for some of its models yesterday, with a maximum drop of 36000 yuan. It is worth noting that Xiaopeng Motor has launched preferential promotion policies for its models many times last year, but its sales have not been improved after a disguised price reduction. Relevant data show that from September to December 2022, the delivery volume of Xiaopeng cars was 8468, 5101, 5811 and 11292 respectively. Judging from the data, Xiaopeng returned to 10,000-class sales in December, which has something to do with the listing of its Xiaopeng G9 and the overall organizational structure adjustment within Xiaopeng. It is understood that Xiaopeng G9 listed on September 21 last year and officially opened large-scale delivery on October 27 last year. Official figures show that 4020 Xiaopeng G9 vehicles were delivered in December.

Xiaopeng wants to break the "curse" of losses after two years. Judging from the current situation of Xiaopeng, it may still be difficult. In the automobile market at the present stage, although new energy vehicles are the trend of the times, there is no fundamental breakthrough in the upstream cost of new energy vehicles, and the scale has not been released for a long time. As far as the new power of car building is concerned, the output is too small, R & D fees, administrative fees and other fixed expenses can not be diluted, in addition, market competition is becoming more and more fierce, losses are normal.

In addition, under the background of Tesla's big price reduction, the new forces of car building will also be affected to a certain extent, and Xiaopeng cars will also have to cut prices to survive. As he Xiaopeng said at this meeting: from 2023 to 2024, there will still be a large number of cost challenges, and in the new five years, we will see that a large number of manufacturers will collapse as in the previous five years. Yes, perhaps for the new power of car building, how to survive on the increasingly fierce track of new energy vehicles, coupled with the cost pressure from upstream raw materials, is particularly important.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.