In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-10-23 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)10/09 Report--

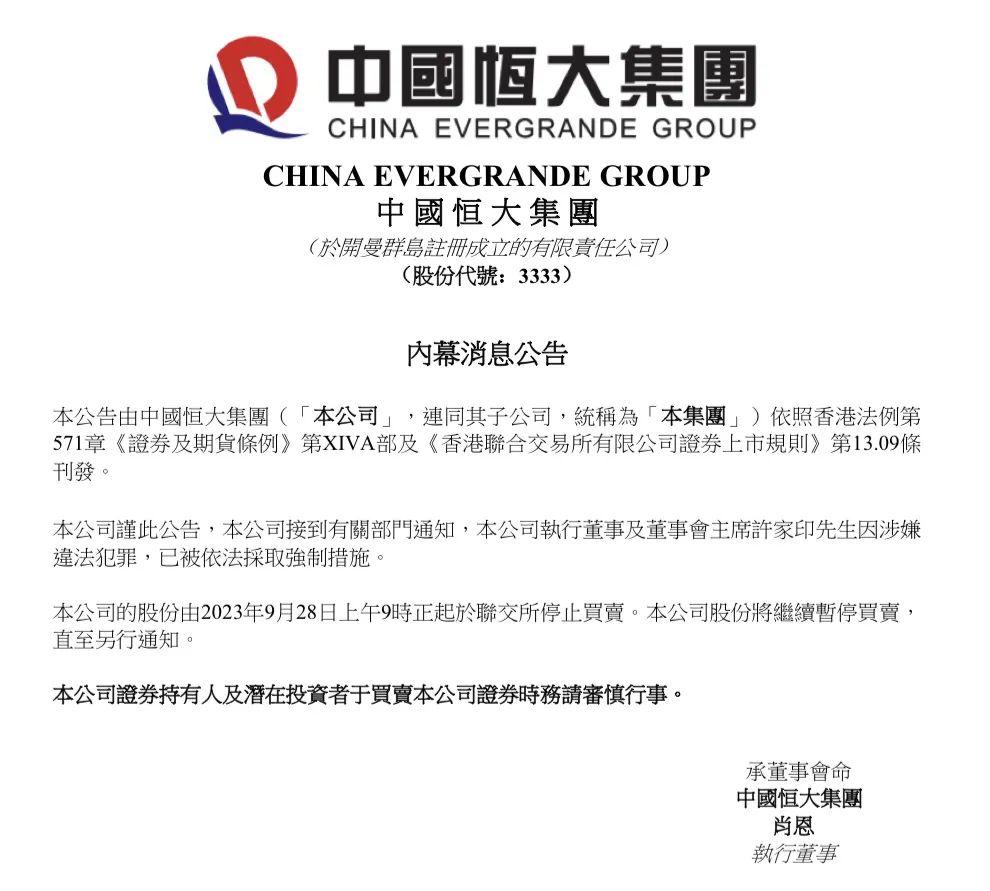

Following China Evergrande, Evergrande property, Evergrande also announced the resumption of license. On the evening of October 8, Evergrande announced that it had applied to the Stock Exchange to resume trading in the company's shares from 9: 00 a.m. on October 9, 2023.

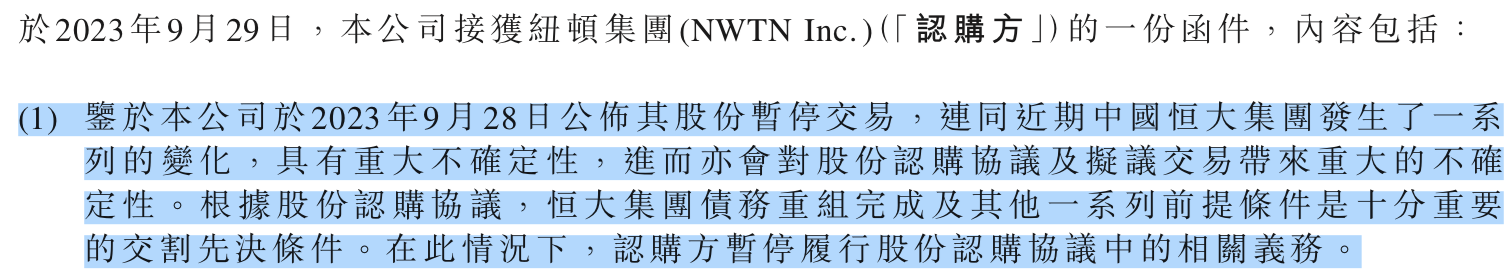

In addition to announcing the resumption of trading, Evergrande also brings an important piece of inside news. Evergrande said in its announcement that on September 29, 2023, it received a letter from Newton that in view of Evergrande's announcement of the suspension of trading in its shares on September 28, 2023, together with a series of recent changes in China Evergrande, in turn, it will also bring significant uncertainty to the share subscription agreement and the proposed transaction. Under the share subscription agreement, the completion of Evergrande's debt restructuring and a series of other prerequisites are very important delivery prerequisites. In this case, Newton Group suspended the relevant obligations under the share subscription agreement.

According to media reports, the above problems mainly focus on the related impact on Evergrande after the changes in the offshore debt restructuring of Evergrande Group, the parent company of Evergrande, and the compulsory measures taken by Xu Jiayin, the board of directors of Evergrande Group.

According to the latest announcement, according to the transitional financial support agreement, due to the current situation that the prerequisites under the share subscription agreement cannot be met, the prerequisites for Newton (Zhejiang) Automobile Co., Ltd. ("fund provider") to pay the second and third tranches of funds to Evergrande New Energy vehicle (Tianjin) Co., Ltd. ("fund recipient") have not been met. For the time being, the fund provider shall not be obliged to pay the second and third tranches to the fund recipient.

In addition, Newton Group hopes that Evergrande Motor will reply to clarify the following aspects: the Evergrande Group debt restructuring plan involved in the share subscription agreement needs to be readjusted, and there are plans to launch a new restructuring plan; China Evergrande, Evergrande Automobile, creditors and related parties are willing to renegotiate the necessary adjustments to the proposed transaction plan on the premise that the new restructuring plan is clear. Newton Group confirms that this letter to Evergrande does not constitute a notice of termination of the share subscription Agreement and does not require termination of the share subscription Agreement as of the date of the letter.

Evergrande said that on October 5, 2023, it sent a reply to Newton expressing its intention to renegotiate with it the adjustments required for the proposed deal. Evergrande said it would issue a further announcement in accordance with the listing rules and acquisition rules in due course. Evergrande's board of directors believes that there is no other inside information that needs to be announced, and Evergrande warned that shareholders and potential investors should proceed with caution as the proposed transaction may not take place.

Industry insiders believe that the reason why Evergrande resumes its license a little later than China's Evergrande and Evergrande property companies may be related to the original strategic investment problems of the Newton Group.

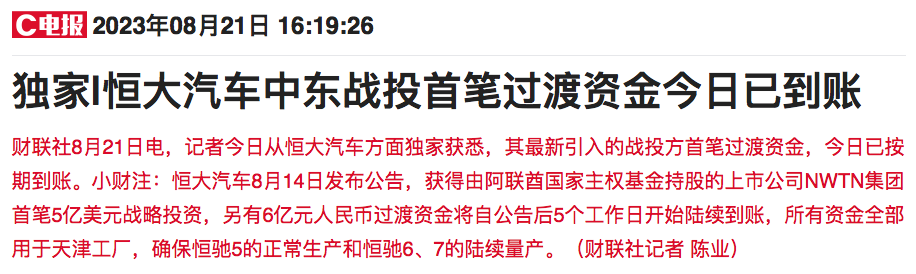

Evergrande of China announced on Aug. 14 that Evergrande Motor has received the first strategic investment of 500 million US dollars (about 3.6 billion yuan) from Newton Group, a listed US stock company held by the United Arab Emirates national sovereign fund. another 600 million yuan of transitional funds will be received one after another five working days after the announcement.

On August 21, the first transition fund introduced by Evergrande Automobile arrived on schedule. According to the plan, all the war investment funds received by Evergrande Automobile will be used in Evergrande Automobile Tianjin Plant to ensure the normal production of Hengchi 5 and the mass production of Hengchi 6 and 7 one after another. Among them, Hengchi 6 is a compact SUV owned by Evergrande New Energy, which was originally scheduled to go offline at the end of 2022 and mass production in the first half of 2023, while Hengchi 7 is a B-class luxury car, which is expected to be offline in the first half of 2023 and mass production in the second half of 2023. However, due to funding problems, both models failed to advance as scheduled, and this capital is the key to mass production of new cars. At the same time, it will help Evergrande expand overseas markets and export 30,000 to 50,000 Hengchi cars to the Middle East market each year.

According to the financial report, Evergrande has made huge losses for two consecutive years, with a cumulative loss of 84.008 billion yuan. According to the semi-annual report of 2023, as of June 30, 2023, the company had total assets of 42.852 billion yuan and liabilities of 75.692 billion yuan. At present, Evergrande has not yet come out of the plight of shortage of funds, and is in a serious state of insolvency. To some extent, the strategic investment of Newton Group can indeed alleviate the urgent needs of Evergrande, but it is far from being able to pull Evergrande out of the quagmire, which is mired in financial crisis. However, Evergrande has stressed before that holding hands with Middle Eastern capital will effectively solve the financial difficulties facing Evergrande's automobile development, so Newton's strategic investment is also considered to be the only vitality of Evergrande. Now the strategic investment of the two sides has changed, which may also mean that the original $500 million strategic investment of Newton Group needs to be renegotiated. From the perspective of Newton Group's increased preconditions for this investment, it is required that "Evergrande Group debt restructuring plan needs to be readjusted, and there are plans to launch a new restructuring plan", which is also relatively difficult for Evergrande Motor at present.

At present, "how to solve the financial pressure" is still a test in front of Evergrande. As for the suspension of Newton's obligations in the share subscription agreement, what will be the impact on Evergrande? There is a view that if Newton's strategic investment ends here, it may push Evergrande into a "desperate situation". Cui Dongshu, secretary general of the Federation of passengers, also said in an interview with the media: "if holding hands with Newton fails this time, it is very difficult for Evergrande to survive." At present, Evergrande officials have not disclosed what impact the incident will have, and what is the final progress of the two sides? we'd better wait for the official announcement.

Before the suspension, Evergrande's share price was HK $0.56, with a total market capitalization of HK $6.073 billion.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.