In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-07-27 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)10/26 Report--

The cooperation between Stellantis Group and Zero Auto, a new force in domestic car building, has finally been decided.

Stellantis Group will invest 1.5 billion euros to acquire a 20% stake in Zero Automobile and become a strategic shareholder of Zero Automobile, it was announced in an official public WeChat account on October 26th. The Stellantis Group will have two seats on the Zero Automobile Board and the CEO of the Zero International Joint Venture will be appointed by the Stellantis Group.

At the same time, the two sides will also form a joint venture called "Zero running International (Leapmotor International)" with a proportion of 51%. With the exception of Greater China, the joint venture has the exclusive right to export and sell to all other markets around the world, as well as the exclusive right to manufacture zero-running car products locally.

Both sides are very optimistic about cooperation. It is believed that each other's existing technology and brand product portfolio can complement each other, which will bring more travel solutions with price-to-price advantages for customers around the world. Tang Weishi, global CEO of Stellantis Group, also said: "with the integration of strong electric vehicle start-ups in the Chinese market, a small number of efficient and flexible new electric vehicle companies, such as zero running cars, will occupy the mainstream market segment of China's electric vehicle market, and this trend is becoming increasingly obvious. It is believed that now is the best time for Stellantis Group to support it and play a leading role in Zero Motor's global expansion plan.

Zhu Jiangming, founder of Zero Motor, said: I believe that the combination of powers formed in the rapidly changing market environment will bring a mutually beneficial and win-win partnership to both sides. Together with the Stellantis Group, we will continue to innovate in the areas of technology and business collaboration, and sell zero-running cars worldwide.

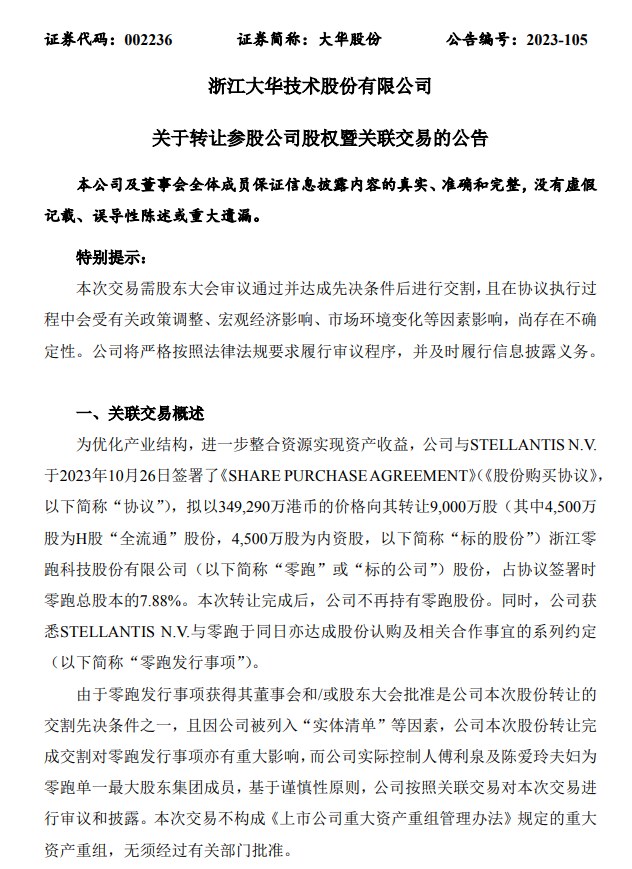

It is worth noting that today, Dahua shares also announced that it intends to transfer 7.88% of its Zero Motor shares to Stellantis at a transaction price of HK $3.493 billion, slightly higher than the closing price of HK $36.80 per share on the 25th. After the deal, Dahua will no longer hold a stake in Zero Motor. It is understood that at the beginning of the establishment of Zero Automobile, there were three main shareholders: Dahua Technology, Fu Liquan and Zhu Jiangming. In fact, there was news in the market as early as July that Stellantis was considering working with Chinese electric carmakers to expand its business in China. At that time, in response to this rumor, Zhu Jiangming, CEO of Zero car, said at that time: "at present, there are two relatively certain (enterprises). One will be the cooperation mode of vehicle technology authorization, and the other will be the authorization cooperation of car body architecture."

Relevant information shows that Stellantis Group is a multinational automobile group formed by the merger of Peugeot Citroen (PSA) and Fiat Chrysler (FCA). It owns Peugeot, Citroen, DS, Opel, Fiat, Chrysler, Alfa Romeo, Jeep, Maserati and many other car brands. Although there are many brands, Stellantis Group does not have a strong sense of existence in the Chinese market. With the withdrawal of Guangzhou Auto Fick, Stellantis Group is left with only a few brands such as Peugeot and Citroen in China, so the situation is not optimistic. In terms of electrification, it lags behind other competitors.

In order to improve competitiveness in the fast-growing new energy vehicle track, officials have said that they plan to invest at least $35.5 billion in electric vehicles and related technologies by 2025, with the goal of selling all pure electricity or hybrid products in the European market by 2030. half of the new energy vehicles are sold in the North American market.

Or in this context, Stellantis has to find another way out. Last year, Stellantis stopped domestic production of its Jeep brand. Recently, Stellantis also sold its remaining auto assets in China to partner Dongfeng Motor Group. Dongfeng Motor Group Co., Ltd. announced on October 19th that Dongfeng Group had signed an "Asset transfer Agreement" for DPCA's purchase of specific land use rights, buildings and structures in Wuhan and Xiangyang, China.

Some industry insiders pointed out that for Stellantis, the acquisition of zero cars is of great significance for the transformation of Stellantis to electric vehicles. After all, the development potential of new energy vehicles in the Chinese market is huge. In fact, under the background of the rapid development of new energy vehicles, many traditional car giants have turned their attention to the new forces of domestic car-building. Many auto giants hope to expand in the domestic market by investing in the new power of car building in China. In July, Volkswagen announced that it had reached a partnership with Xiaopeng Motor, investing US $700 million in Xiaopeng Motor, and the two sides would jointly develop electric vehicles in China.

This cooperation with Stellantis Group is undoubtedly a considerable capital injection for Zero cars. As we all know, zero-running car products always follow the volume route, so it is difficult to get enough profit on product pricing, so it is still in a huge loss. Relevant data show that the operating income of zero-running cars in the first half of 2023 was 5.813 billion yuan, an increase of 14.4 percent over the same period last year, with a net loss of 2.276 billion yuan in the first half of 2023, with a net loss rate of 39.12 percent. In terms of gross profit margin, the gross profit margin for the first half of the year was-5.9%. In terms of cash flow, cash and equivalents as of the second quarter were 7.108 billion yuan.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.