In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-07-27 Update From: AutoBeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)04/24 Report--

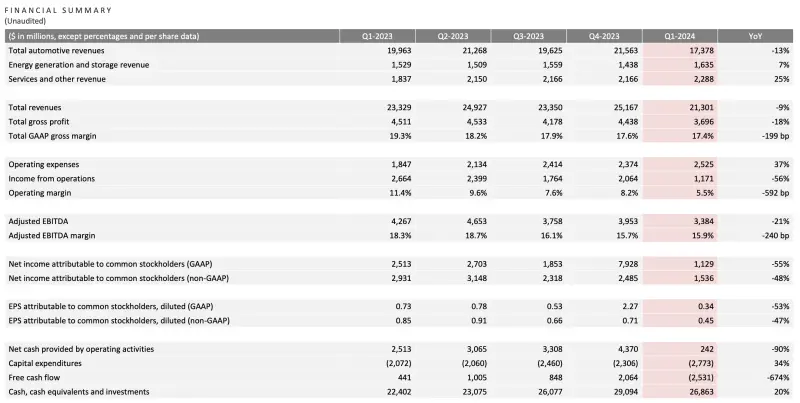

Tesla released his first-quarter 2024 results after the US stock market opened on April 23rd. According to the data, Tesla's operating income in the first quarter of 2024 was US $21.301 billion, down 8.69% from the same period last year and 15.36% from the previous month, lower than market expectations. It was also the first year-on-year decline in operating revenue since 2020 and the biggest decline since 2012. In terms of profits, Tesla's performance was even less optimistic, with a net profit of only $1.13 billion in the first quarter, down 55.07% from a year earlier and below market expectations of $1.9 billion. During the reporting period, Tesla's gross profit margin was 17.4%, compared with 17.6% in the previous quarter and 19.3% in the same period.

In addition, the free cash flow of Tesla during the reporting period was-2.53 billion US dollars, compared with 2.06 billion US dollars in the previous quarter, which is Tesla's negative figure again since 2020. Tesla said that cash flow "beyond its means" was due to an increase in inventory of $2.7 billion in the quarter and capital expenditure of $1 billion on artificial intelligence infrastructure, which will continue to increase core AI infrastructure capacity in the coming months.

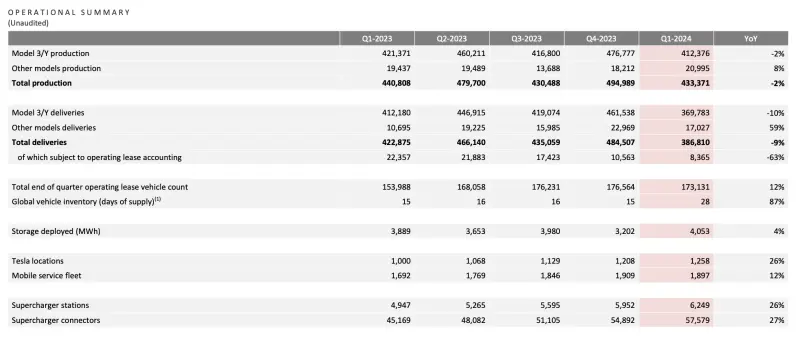

Tesla's latest financial report is obviously "disappointed", which is mainly due to market concerns on car delivery. In the first quarter of this year, Tesla delivered 386000 new cars worldwide, down 8.5% from the same period last year and far below Wall Street's forecast of 449000. It is understood that this is the first time that Tesla's delivery has fallen below 400000 vehicles since the third quarter of 2022, and it is also the first quarterly delivery decline since the second quarter of 2020, when the decline was mainly due to the epidemic.

The United States and China are Tesla's two biggest markets in the world. Not long ago, Tesla announced a price reduction in the Chinese and American markets, of which domestic Model Y dropped to 249900 yuan, a record low since China. In addition, Model 3 dropped to 231900 yuan, Model S price dropped to 684900 yuan, and Model X price dropped to 724900 yuan. The purpose of the price reduction is to strengthen competition with domestic electric cars, and then to improve the level of delivery.

Affected by the performance, Tesla announced a 10% layoff on April 15. Musk announced the news in an internal email and social platform, saying it was "a decision I hate but had to make." Tesla's US marketing team, which focuses on making car advertisements for Tesla, is made up of 40 employees and led by senior manager Alex Ingram, Bloomberg reported. It is understood that Alex Ingram is also within the scope of layoffs.

Tesla's earnings were much lower than market expectations, coupled with layoffs and a comprehensive Cybertruck recall, exacerbated investors' growing concerns, Tesla in the secondary market is the best proof. In the announcement of layoffs, Tesla's share price plunged 5.59%, wiping out more than $30 billion in market value. Tesla's share price has fallen 41.77% since 2024, including 14.03% last week, with a total market capitalization of $461.4 billion, falling below the $500 billion mark.

Investors urgently need to know the latest situation of Tesla's current and future prospects, and it can be said that this financial report is likely to be a "crossroads" that determines Tesla's near-term fate, or even one of the most important moments in the company's history. After the first quarter, Tesla needs to reassure investors that the current experience is only temporary, not the beginning of a market recession.

Although revenue and profits were much lower than market expectations, Tesla's share price soared in after-hours trading because the market was most looking forward to new developments in cheap electric cars. Tesla CEO Musk said on a conference call after the results that Tesla would accelerate the launch of cheaper Jing Shi models, which led to a further rise in its share price and an overall increase of more than 13% in after-hours trading. Musk said that cheap models are expected to be on the market in early 2025, even in late 2024. "the new models will not be independent of any new factories or large-scale new production lines, as our existing production lines can further improve the efficiency of vehicle manufacturing," Mr Musk said. "

Meanwhile, Tesla's Chinese official website shows that the Model 3 high-performance all-drive version is officially on sale at 335900 yuan and is expected to be delivered in the third quarter of 2024. The new car will be equipped with dual motors, namely front induction induction motor (3D 3) and rear permanent magnet synchronous motor (4D2), and adopt four-wheel drive form, which can output maximum power of 460hp, maximum torque of 723N ·m, 0-100km/h acceleration time of 3.1s and maximum speed of 261km/h. Musk said the Model 3 was faster than Porsche 911.

At the beginning of the launch of the Model 3 Performance, there are indeed few models that can compete with it, but with more Chinese brands launching performance models one after another, it is no longer a king in the domestic market, bearing the brunt of the newly launched Xiaomi SU7, which is close to the Model 3 Performance in terms of power data, but the body size and market heat do bring a lot of pressure to the launch of the new Model 3 Performance. However, Tesla Model 3 Performance has more advantages in its intelligent configuration and control, including its strong user base, which will become the focus of attention after the launch of the new car.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.