In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-07-27 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)05/12 Report--

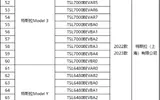

Today, according to Tesla's US official website, the price of some Tesla models in the US market has been raised. Among them, the prices of Model Y series models are all raised by US $250, and the prices of ModelS and ModeX models are both raised by US $1000.

The Model Y renewal price rose $250 to $47490 (about 330000 yuan), the long-lasting version of Model Y rose $250 to $50490 (about 350800 yuan), and the high-performance version of Model Y rose $250 to $54490 (about 378600 yuan). The adjusted price of Model S is $88490 (about 614700 yuan) in the United States, and the adjusted price of the Model S Plaid version is $108490 (about 753700 yuan) in the United States. The price of Tesla Model X rose $1000 to $98490 (684200 yuan), while the Model X Plaid version rose $1000 to $108490 (753600 yuan).

It is worth noting that last week Tesla raised the prices of some models in the US market. The price of the long-lasting version of Model Y rose to $50240 from the previous price of $49990, the price of the high-performance version of Model Y to $54240 from $53990 before, and the price of Tesla Model 3 to $40240 from $39990 before. On the same day, Tesla also raised the price of his models in the Chinese market. Specifically: on May 2, the prices of Tesla Model 3 and Model Y models were raised by 2000 yuan. After price adjustment, the price of Model 3 starts at 232900 yuan and that of Model Y starts at 263900 yuan.

On May 5, Tesla China again raised the prices of some of its models, including the Model S and the new Model X by 19000 yuan. The adjusted price of the Model S dual-motor all-wheel drive version is 808900 yuan, the Model S Plaid three-motor all-wheel drive version is 1.0289 million yuan, the Model X dual-motor all-wheel drive version is 898900 yuan, and the Model X Plaid three-motor all-wheel drive version is 1.0589 million yuan.

With regard to Tesla's recent price increase, Tesla's Chinese customer service once revealed in an interview with the media: this price increase is mainly affected by the rise in the price of raw materials and the shortage of vehicles. As we all know, Tesla adopts a direct sales model, and the vehicle price adjustment reflects the actual situation of cost fluctuations. This time Tesla raised the prices of Model 3 and Model Y again, largely due to the supply of spare parts and the rise in the price of raw materials for power batteries. According to data released by Shanghai Iron and Steel Federation, battery-grade lithium carbonate rose 17500 yuan / ton today, with an average price of 247500 yuan / ton, while industrial-grade lithium carbonate rose 27500 yuan / ton, with an average price of 235000 yuan / ton.

However, some industry insiders disagreed with the response to the customer service, pointing out: at present, the price of lithium carbonate raw materials has been declining sharply since the beginning of the year, and there is no cost pressure for rising raw material prices. In addition, if supply really falls short of demand, what needs to be done is to increase production, not to raise prices. At the same time, some people in the industry said: Tesla's earlier price reduction behavior can indeed bring an increase in sales to Tesla, but the prominent problem is the decline in its gross profit margin, so that profits and sales can only be balanced by raising prices.

According to the first-quarter financial results released earlier by Tesla, due to the lower-than-expected performance, investors are also worried about the future development of Tesla. As of press time, Tesla's share price is $170.08, with a total market capitalization of $545.4 billion, halving from its peak. In the first quarter of 2023, Tesla delivered 423000 electric vehicles worldwide, an increase of 36% over the same period last year, a record high, but the growth rate has slowed significantly. During the reporting period, Tesla achieved operating income of $23.33 billion (about RMB 161.53 billion), an increase of 24% over the same period last year, and the market expected to be $23.21 billion; net profit was $2.513 billion (about RMB 17.4 billion), down 24% from the same period last year; the market is expected to be $2.725 billion; gross profit margin is 19.3%, market expectation is 21.2%

Or in the context of rising raw material prices, Tesla's own gross profit margin in the first quarter was lower than market expectations, Tesla also had to adjust the price of his models. Of course, Tesla's price increase, from the extent of its price increase, will not have a great impact on its delivery volume. However, with regard to Tesla's recent price increase, the Federation said: this is a very good signal that reflects the attention of car companies to the quality of operation, helps to improve the wait-and-see mentality of consumption, and allows consumers to get out of the expectation of excessive price reduction and return to the normal buying rhythm. Tesla's price increase will help to promote the healthy development of the automobile market and avoid vicious competition and profit decline brought about by the price war.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.